Income Tax Return Form Download Excel Format

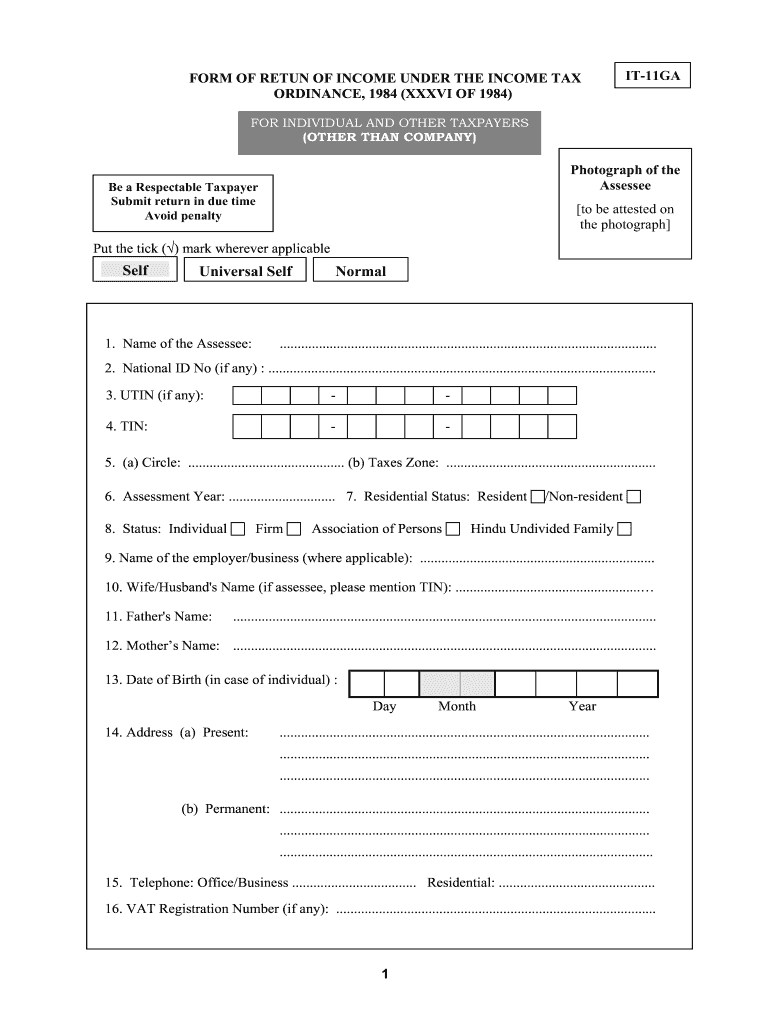

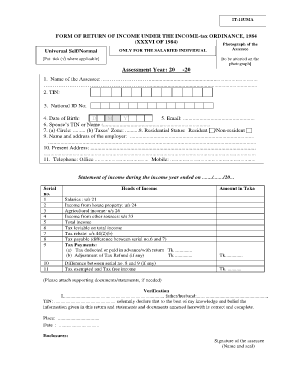

The kra returns form comprises of different sections that are to be filled using the date shown on the p9 form.

Income tax return form download excel format. 16 16a and 27d. Form description microsoft excel java instructions. Income tax forms for employers. However the excel utilities or java utilities for ay 2020 21 will soon be made available on e filing website.

The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. 41 2010 dated 31 05 2010 view. Download free federal income tax templates in excel.

Return of employee s remuneration form ir8a for the year ended 31 dec 2020 year of assessment 2021 form ir8a doc 126kb form ir8a explanatory notes pdf 100kb. Description of the form notification circular. The new itr forms in pdf format are available. Insertion of form no.

Before jumping to understanding the new forms let us first understand the income tax slabs for fy 2019 20 or ay 2020 21 from the below image. Form 16 is also known as the income tax calculator and it consists of two parts part a and part b if you want to file it returns for the financial year 2019 20 in the assessment year 2020 21 then you can easily calculate your net income tax return amount by using the above form 16 excel format. Download income tax challan other forms in excel fillable pdf 17 280 281 282 283 form 3cs 3cb 3cd 10a 10ba 10dc 10e 13 15d 15g 15h 15i 3ca 3cb 3cd itr 1 itr v. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail.

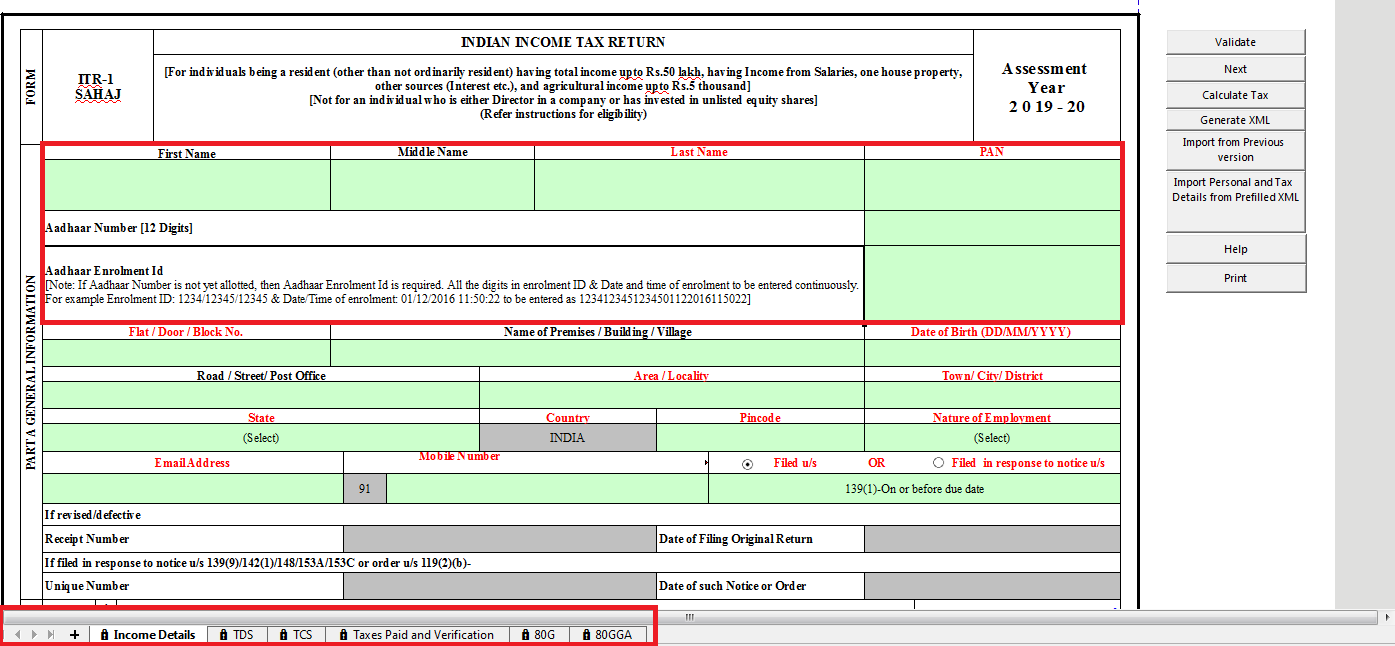

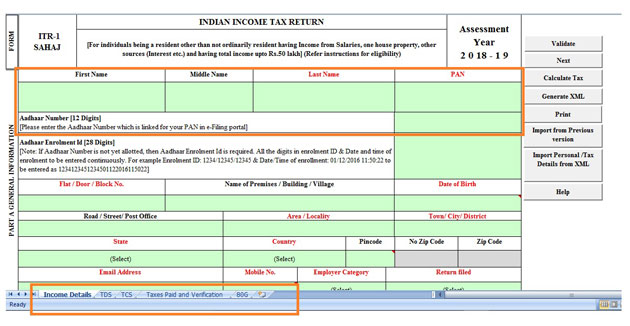

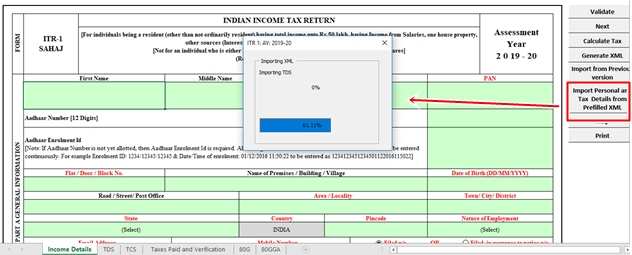

Form name last updated 1a. Prepare your federal income tax return with the help of these free to download and ready to use ready to use federal income tax excel templates. The returns form is also know as the income tax resident individual form excel that is downloaded from the kra itax portal by a taxpayer and is filled according to the date from the p9 form. For individuals being a resident other than not ordinarily resident having total income upto rs 50 lakhs having income from salaries one house property other sources interest etc and agricultural income upto rs 5 thousand not for an individual who is either director in a company or has invested in unlisted equity shares.

Income tax sixth amendment rules 2010 substitution of rules 30 31 31a 31aa 37ca and 37d.