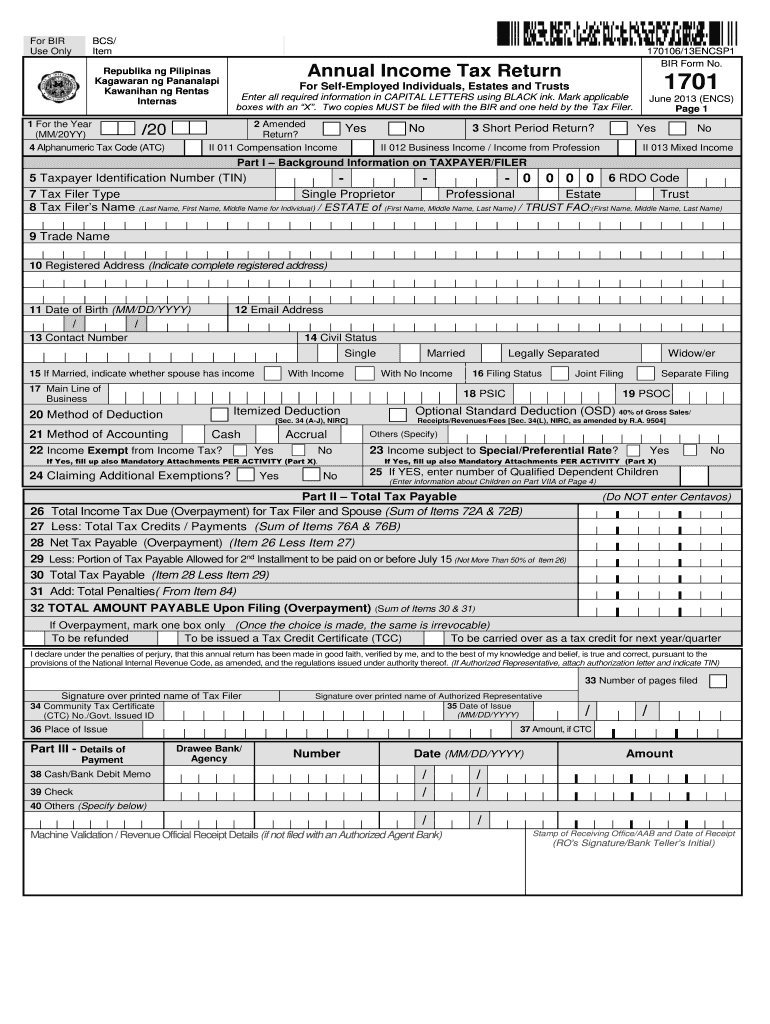

Income Tax Return Form Fill Up Sample

Just find out the form you need and fill it for an easy return.

Income tax return form fill up sample. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. 1701q download quarterly income tax return for individuals estates and trusts. After filling up the form click on the validate button on the form itself to make sure that all the necessary fields have been filled up. But there is nothing to worry about.

Who can file form itr 1 sahaj. There is no tax levied to an individual or huf if he is earning. This return is filed on or before april 15 of each year covering income for the preceding taxable year. Next you will find the pdf and fillable form options available under form 16.

Log on to e filing portal at https incometaxindiaefiling gov in. How can i file my income tax return online and that too free. You may be one of them. Once you have downloaded the offline utility file fill up the fields with the relevant information of your income tax payable and receivable refunds.

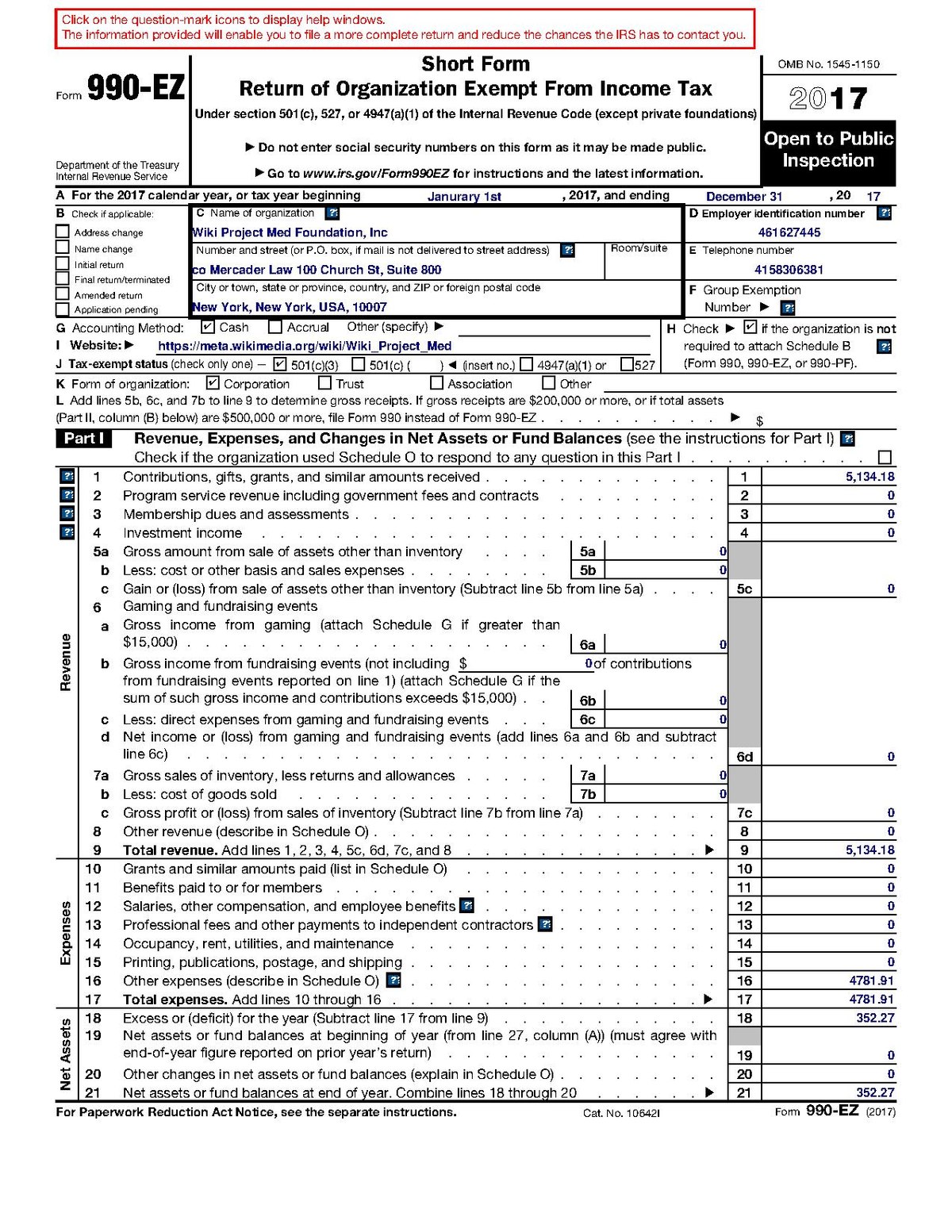

Click on the relevant option. In 2014 income tax department has identified additional 22 09 464 non filers who have done high value transactions. Under the forms download section you will find the income tax forms option click on it. Here is a step by step guide to file your income tax return online.

The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts. In 2013 income tax department issued letters to 12 19 832 non filers who had done high value transactions. This form summarizes all of the income or loss you have incurred for the past year. When a person exceeds the basic exemption limits he files the income tax return income tax is not collected from the person whose income is below limit as prescribed by the government.

Those who availed of the 8 flat income tax rate whose sales receipts and other non operating income do not exceed p3m. If you are not registered with the e filing portal use the register. If you are certain that you have to file but do not receive a notification from us by 15 mar 2020 please contact us. Apparently the process of filing returns seems to quite confusing.

50 lakhs in the financial year f y 2019 20 i e from 1st april 2019 to 31st march 2020 from the following. Visit the official website of the income tax department. Browsing this you will get samples tax forms meant for different purposes like a tax return tax exemption tax extension etc. The income tax return itr that most people refer to is actually the annual tax form that an individual files every april 15th of the following year.

This form can be filed by resident individuals who have income upto rs. If you need to file tax iras will send you the relevant paper tax return between feb to mar each year.

/ScreenShot2020-02-03at10.24.39AM-c09a8077358e4cf28b62f33b658b3254.png)