Income Tax Return Formula

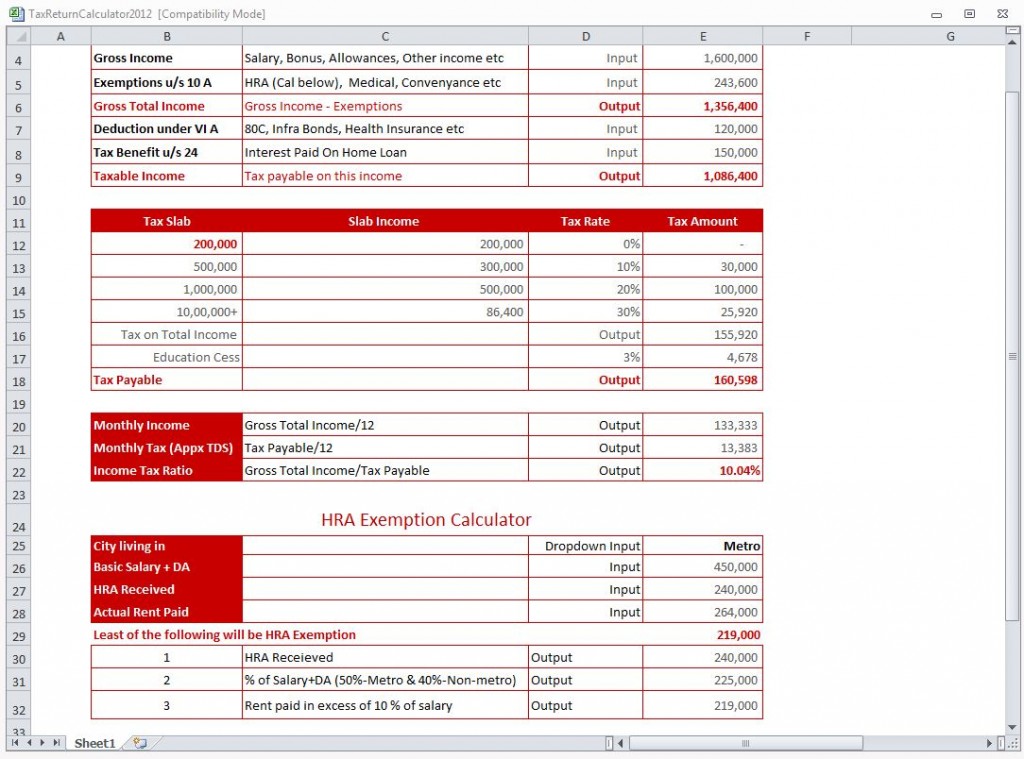

The formula in g5 is.

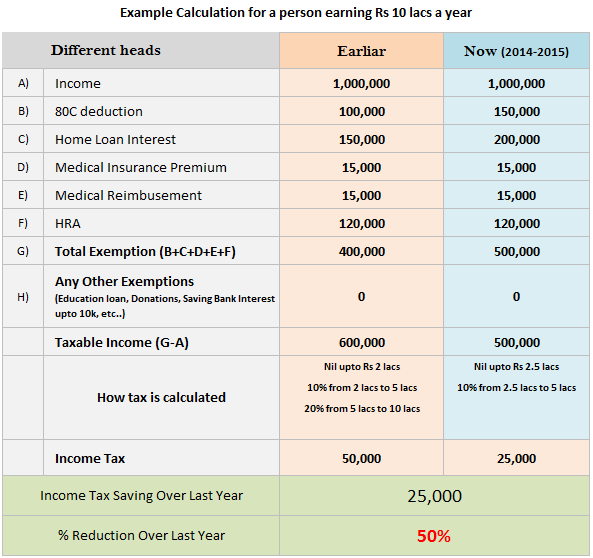

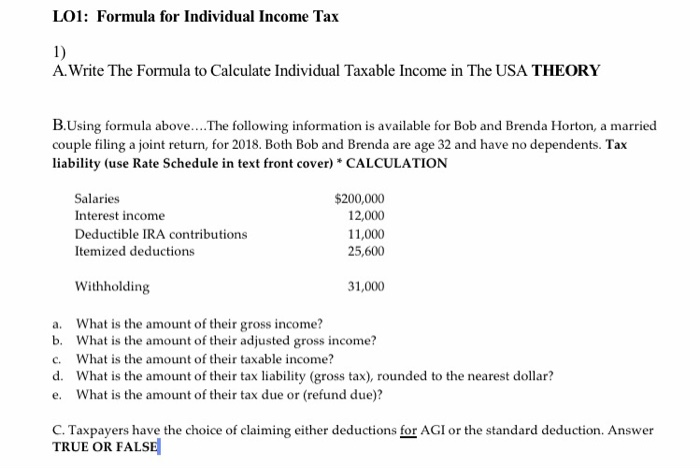

Income tax return formula. Tax deductions and tax credits explained. Taxable income formula gross sales cost of goods sold operating expense interest expense tax deduction credit. To calculate total income tax based on multiple tax brackets you can use vlookup and a rate table structured as shown in the example. Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income that s subject to a marginal tax rate.

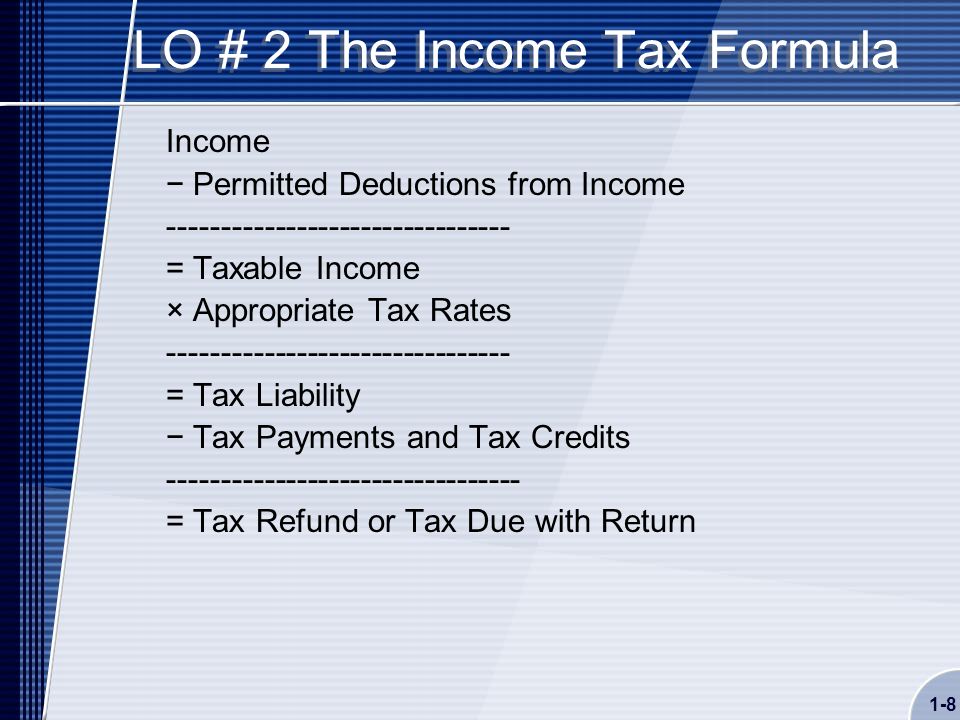

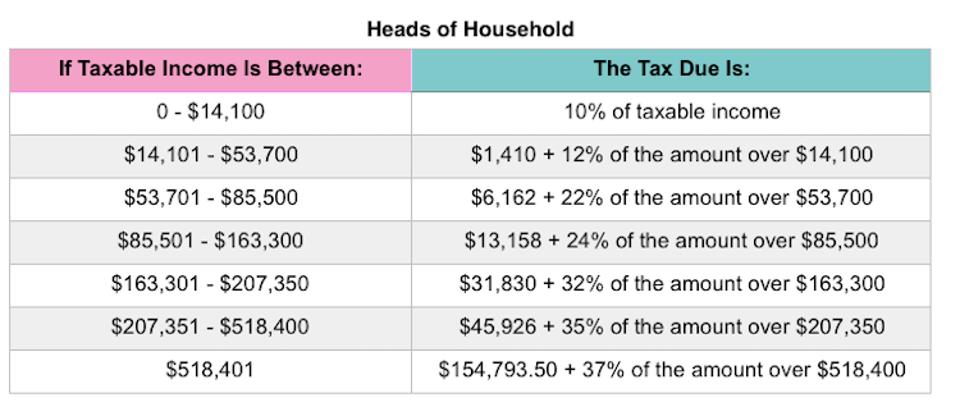

The formula for calculating income tax is the product of the total amount of taxable income multiplied by the tax rate according to the internal revenue service. If we assume a taxable income of 50 000 we need to write a formula that basically performs the following math. Vlookup inc rates 3 1 inc vlookup inc rates 1 1 vlookup inc rates 2 1. A tax return calculator takes all this into account to show you whether you can expect a refund or not and give you an estimate of how much to expect.

In 2014 income tax department has identified additional 22 09 464 non filers who have done high value transactions. Log on to e filing portal at https incometaxindiaefiling gov in. Income tax expense formula taxable income tax rate additionally income tax is arrived at by showing only the tax expenses that occurred during a particular period when they were incurred and not during the period when they were paid. In 2013 income tax department issued letters to 12 19 832 non filers who had done high value transactions.

Rental calculator for tax resident and non resident individuals xls 362kb compute rental income for tax resident and non resident individuals. You may be one of them. Parenthood tax rebate eligibility tool xls 362kb. Compute income tax liability for tax resident individuals locals and foreigners who are in singapore for 183 days or more 2.

The formula to account for multiple marginal tax rates requires multiplying the total amount of money earned in each successive bracket by the tax rate and adding the values together.