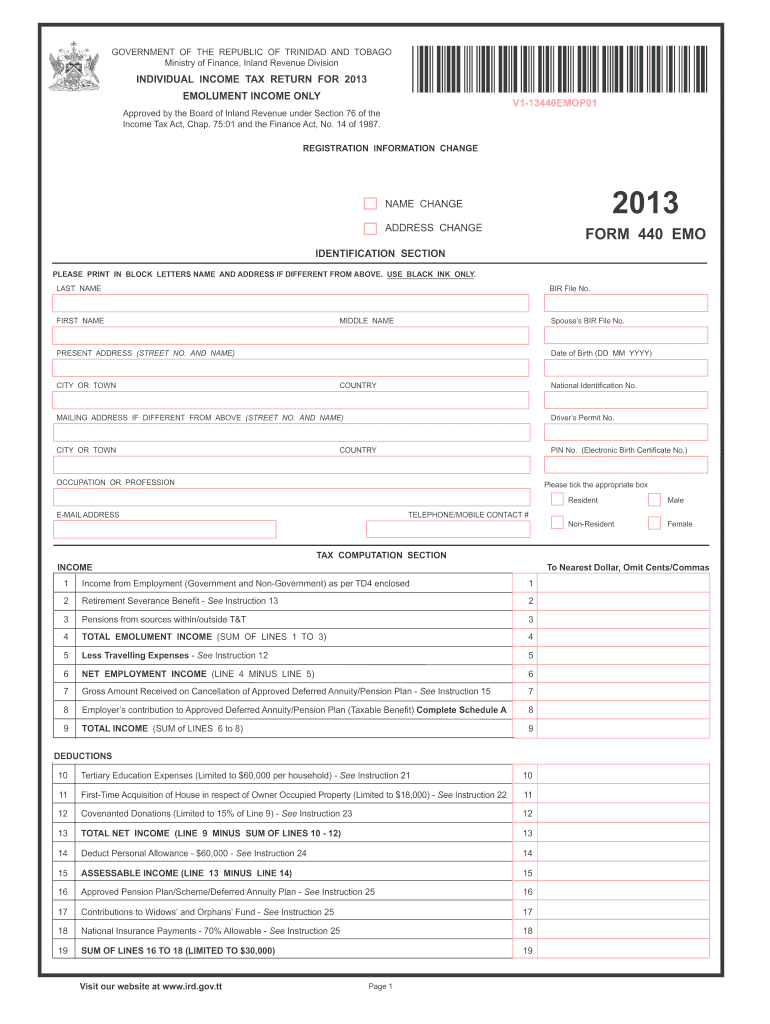

Individual Income Tax Return Form 2019 Trinidad

For more information see march 2020 3 pdf issue of the maine tax alert.

Individual income tax return form 2019 trinidad. Forms tax return tax return instructions request application exemption certificate spreadsheet td1. Personal income tax rates. A non resident individual is taxed on income arising in trinidad and tobago subject where applicable to the provisions of double taxation treaties dtts. When filing you must include schedules 3 7 and ct 40 along with form it 40.

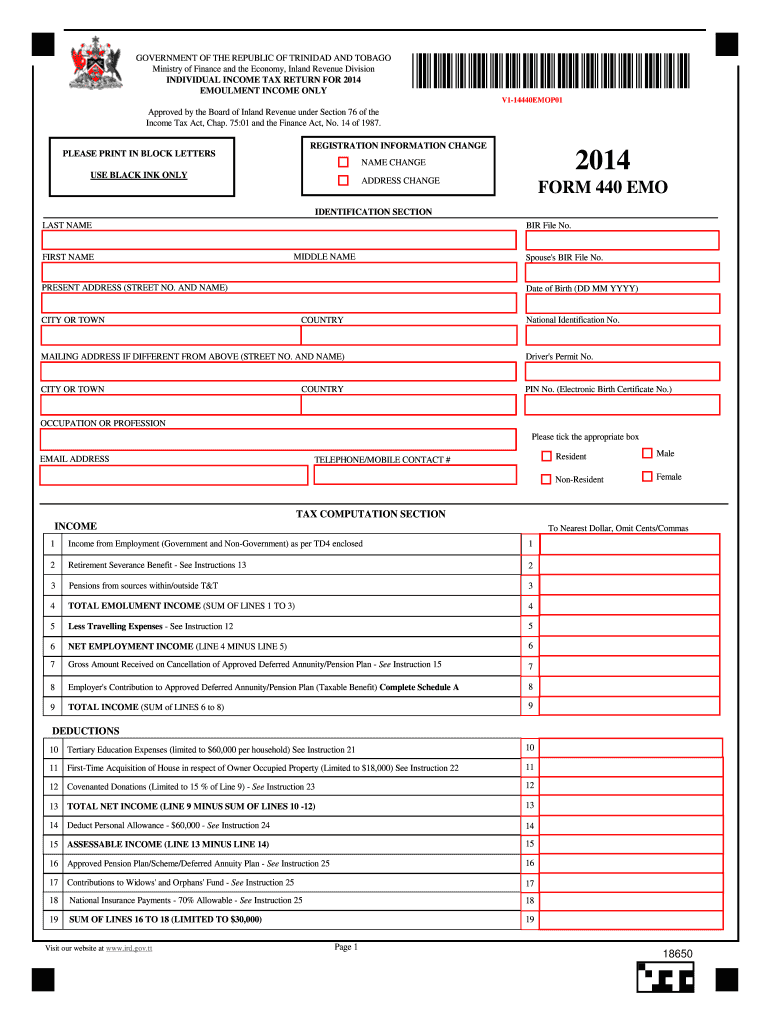

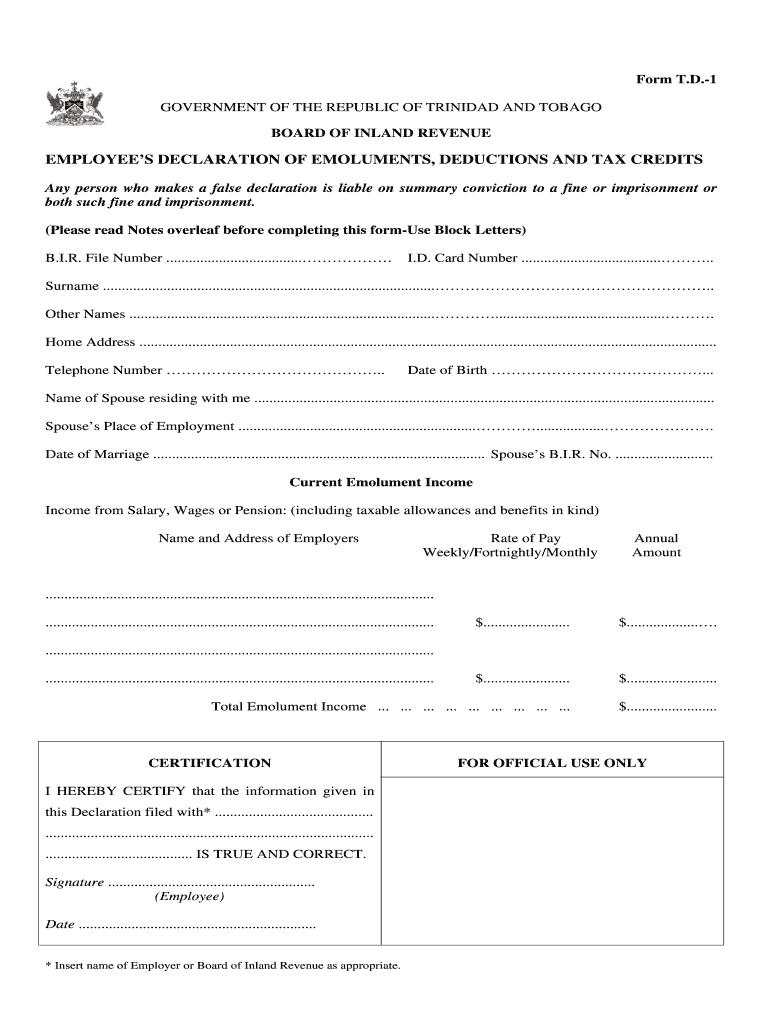

Us individual income tax return. 2019 it 40 income tax form important. Individual income tax forms 2019 note. E tax 440 emo emolument income earner file on line through e tax.

We ll continue to process jobkeeper declarations up until our systems close for maintenance and start again as soon as they are back online. Net operating loss deduction due to the federal cares act this form is no longer available. Printable 2019 irs form 1040. Our online services are unavailable this weekend.

This is the main menu page for the t1 general income tax and benefit package for 2019. Printable and fileable form 1040 for income earned in 2019 and to be filed by april 15 2020. High call volumes may result in long wait times. For more information on who is eligible for the premium tax credit see the instructions for form 8962.

Homestead property tax credit claim. The april 15 2020 due date for filing 2019 maine income tax forms and payments has been extended to july 15 2020. 2019 it 40 income tax instruction booklet not including form or schedules 09 19. You may rely on other information received from your employer.

Before calling us visit covid 19 tax time essentials or find answers to our top call centre questions. Individuals can select the link for their place of residence as of december 31 2019 to get the forms and information needed to file a general income tax and benefit return for 2019. Form to file your return. For individual applicants apply on line through e tax.

Mi 1040 book with forms 64 pages mi 1040 book instructions only no forms mi 1040cr. The income tax rate for individuals with chargeable income less than ttd 1 million is 25. Instructions included on form. Each package includes the guide the return and related schedules and the provincial information and forms.

You will need the individual tax return instructions 2019 supplementary section to help you complete this part of your income tax return.