Kwsp Penalty For Late Payment

They will reply you quite quickly with info they pull out from your acc n ur employer s.

Kwsp penalty for late payment. Imprisonment term not exceeding 6 years or a fine not exceeding rm20 000 or both. If u find something off just email them. The late payment charge will be rounded up to the nearest ringgit denomination. Deducts the employee s share of contributions from the wages and fails to pay to epf.

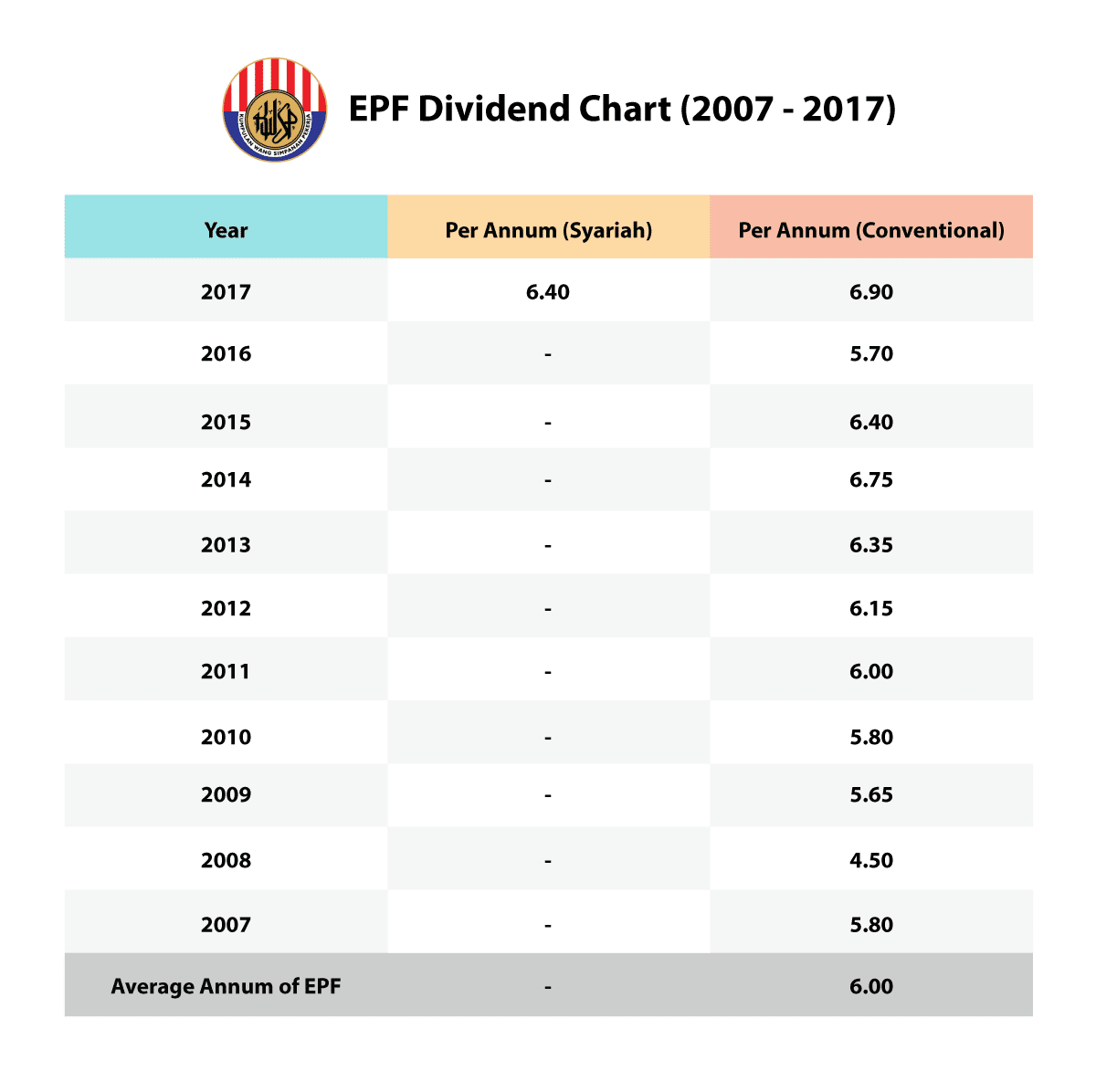

Late payment charges replaces interest. Penal damages for late payment under section 14b. Before there is a dividend rate for simpanan shariah epf dividend rate declared for each respective year shall be referred to for the calculation of late payment charges and dividend. As employee you don t have to worry.

No of days delayed in making payment x 5 p a less than 2 months no of days delayed in making payment x 10 p a 2 months and above but less than 4 months. If the tax and penalty imposed is not paid within 60 days from the date the penalty is imposed a further penalty of 5 will be imposed on the amount still owing. Late payment letter template word pdf by business in a box. For every single day that there is a delay in epf payment.

I forgot once terus kena diao by epf. A which shall not be less than one year and a fine of ten thousand rupees in case of default in payment of the employees contribution which has been deducted by the employer from the employees wages. If late sure kena penalty one. Epf interest for late payment under section 7q when an employer fails to deposit the epf contribution before its deadline then he is liable to pay an epf interest of 12 p a.

The minimum late payment charge imposed is rm10. No of days delayed in making payment x 12 p a penal damages under section 14b. Got my letter summoning payment for penalty within 14 days notice bla bla. The late payment charge imposed is rm13 21 and this must be rounded up to rm14.

Dividend rates will be based on the lowest between the simpanan konvensional and simpanan shariah. Furthermore a late payment penalty of 10 will be imposed on the balance of tax not paid after 30th april following the year of assessment. Employees provident fund forgotten user id password 2. B which shall not be less than six months and a fine of five thousand rupees in any other case.

Ten billion in bonds looted from epf to raise four billion dollars. For the calculation of late payment charges the percentage rate imposed is equivalent to the amount of dividend and an additional rate of one 1 per cent.