Pakistan Income Tax Return Form 2018 19 Pdf

Individual paper income tax return 2019.

Pakistan income tax return form 2018 19 pdf. Those having obtained a national tax number ntn or registration number but do not have credentials to log into iris can get access by clicking on e enrollment for registered person. Of printing at government of india press ring road mayapuri new delhi 110064 and published by the controller of publications delhi 110054. Individual paper income tax return 2018. Before getting into details of types itr forms like itr 1 itr 2 itr 3 4 5 6 7 tds certificate and form 16 for salaried person let us see what all you will require to file income tax return online for 2018 19.

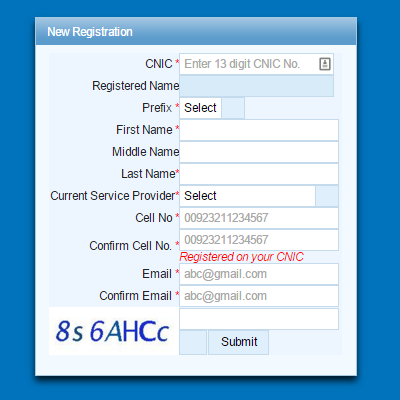

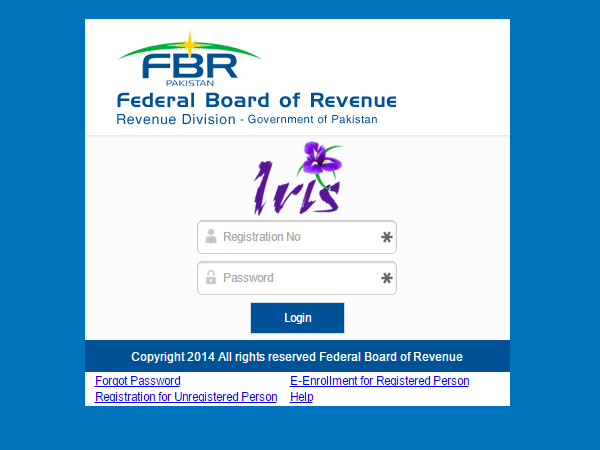

Federal board of revenue govt of pakistan. 2018 4 18вђ в вђ itr 1 form for ay 18 19 now available for e filing the new itr forms for the ay 2018 19 mandate the salaried class assessees to provide their salary breakup and businessmen their gst number and turnover tax2win is the reliable source to e file income tax return for fy 2018 19 ay 2019 20. However for tax year 2017 the rates increase where the seller of securities is a non filer meaning it has not filed its latest pakistan income tax return and is therefore not borne on the active taxpayers list of the board of revenue. After registration you can log into iris and file your income tax return.

This initiative will benefit more than three crore tax payers who will be eligible to file their return of income in this simplified form. Income tax return forms ay 2019 20 fy 2018 19 which form to use. Check for form 16 and tds salaried person. Income tax return form individual paper income tax return 2020.

Each return form is applicable according to the status of taxpayer and type of income he earns during the year. Itr forms for fy 2018 19 income tax assessment form 2019 20 changes in itr forms for ay 2019 20 itr forms for fy 2018 19 download itr forms for fy 2018 19 pdf income tax return form 2018 19 excel format income tax form 2018 19 pdf itr 2 for fy 2018 19. Before jumping to know about the forms let see the new changes in income tax return forms ay 2018 19 fy 2017 18. Itr filing 2018 19 a step by step guide on how to file.

Where the data of the return of income in form itr 1 sahaj itr 2 itr 3 itr4 sugam itr 5 itr 6 itr 7 filed and verified. Held 12 months held 12 24 months held 24 48 months. The increased rates in this case are as follows. Launch of new single page itr form 1 sahaj.

You can use this form in case salary or pension income income from one house property excluding cases where the loss is brought forward from previous. Choose the tax slab you fall into 2 select the itr form 3.