Register Income Tax Malaysia

150 tarikh kemaskini.

Register income tax malaysia. Please upload your application together with the following document. Before you can complete your income tax returm form itrf via ezhasil e filing the first step you have to take is to register at ezhasil e filing website. Supporting documents if you have business income. Registering for a malaysian tax number is not very complicated.

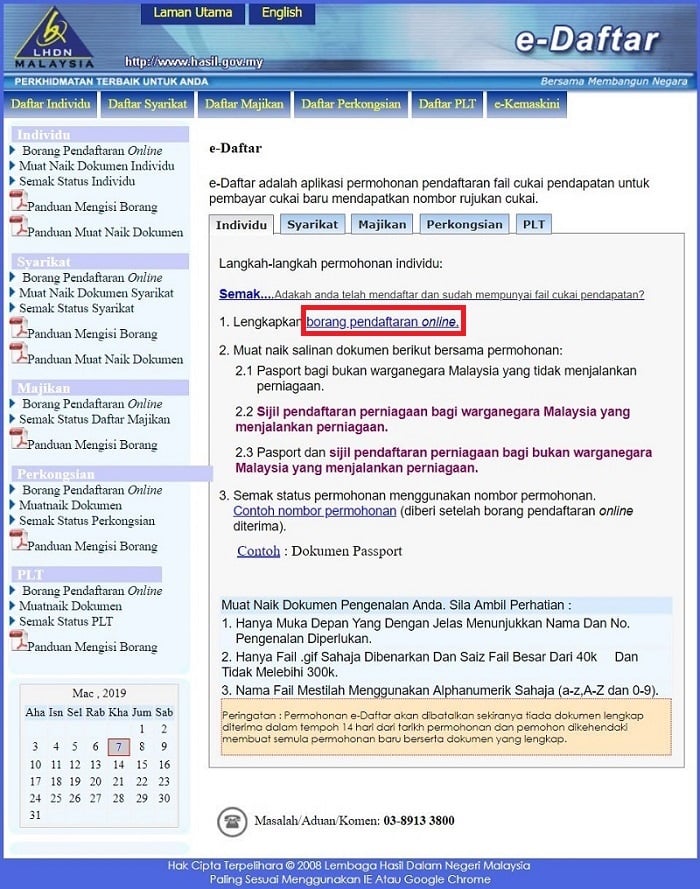

Lengkapkan borang pendaftaran online. 2 2 business registration certificate for malaysian citizen who carries on business. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. You can do the registration either on line or at the nearest branch of the malaysian inland revenue board irbm lembaga hasil dalam negeri malaysia.

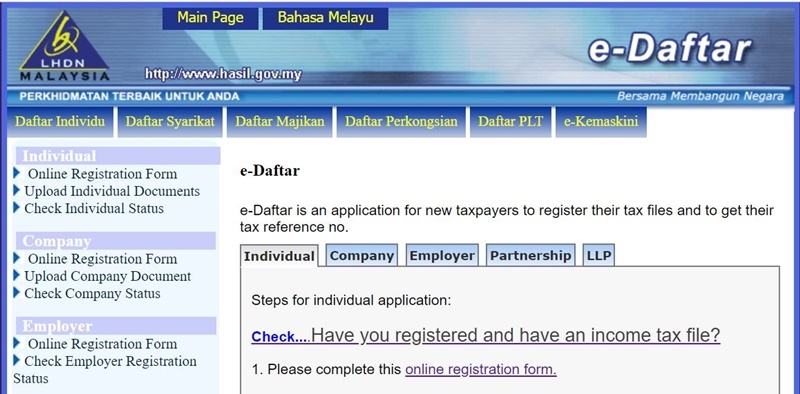

An application via internet for the registration of income tax file for individuals companies employer. Pada amnya stokc digunakan bagi tujuan tuntutan bayaran balik cukai jualan dan perkhidmatan cukai nilai tambah atau cukai barangan dan perkhidmatan sst vat dan gst yang dibayar di luar negara oleh individu syarikat atau badan orang di malaysia. This is the responsible agency operated by the ministry of finance malaysia. Please complete this online registration form.

2 1 passport for non citizen who does not carry on business. Lembaga hasil dalam negeri malaysia abbreviated lhdnm. Please bear in mind that you must be registered as taxpayer prior to registering for ezhasil e filing. 2 2 sijil pendaftaran perniagaan bagi warganegara malaysia yang menjalankan perniagaan.

The income tax number is allocated by the inland revenue board of malaysia when you register for tax. Your income tax number is a unique reference number that is to be used by you in all dealings with the inland revenue board of malaysia malay. An e register application will be cancelled if complete documents is not received within 14 days from the date of application and an applicant must make a new application together with complete document. Untuk makluman stokc adalah pengesahan yang dikeluarkan oleh lhdnm ke atas status seseorang yang dikenakan cukai di malaysia.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Muat naik salinan dokumen berikut bersama permohonan. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. 2 3 passport and business registration certificate for non citizen who carries on business.