Sales Tax Exemption Malaysia 2018

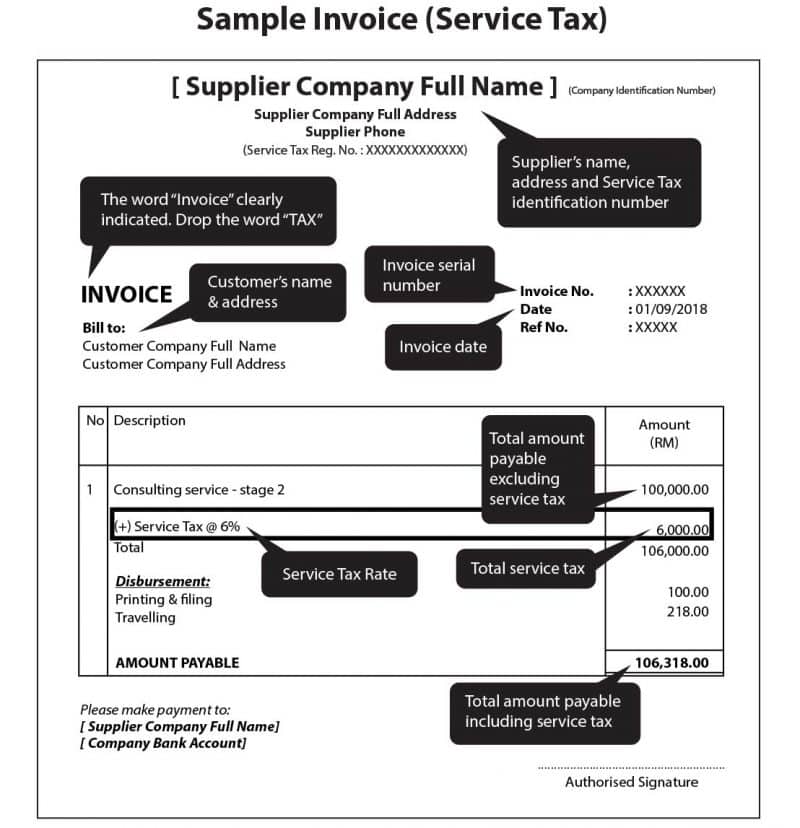

The introduction of the sst which replaces the goods and services tax gst sets its rates at 10 for goods and 6 for services.

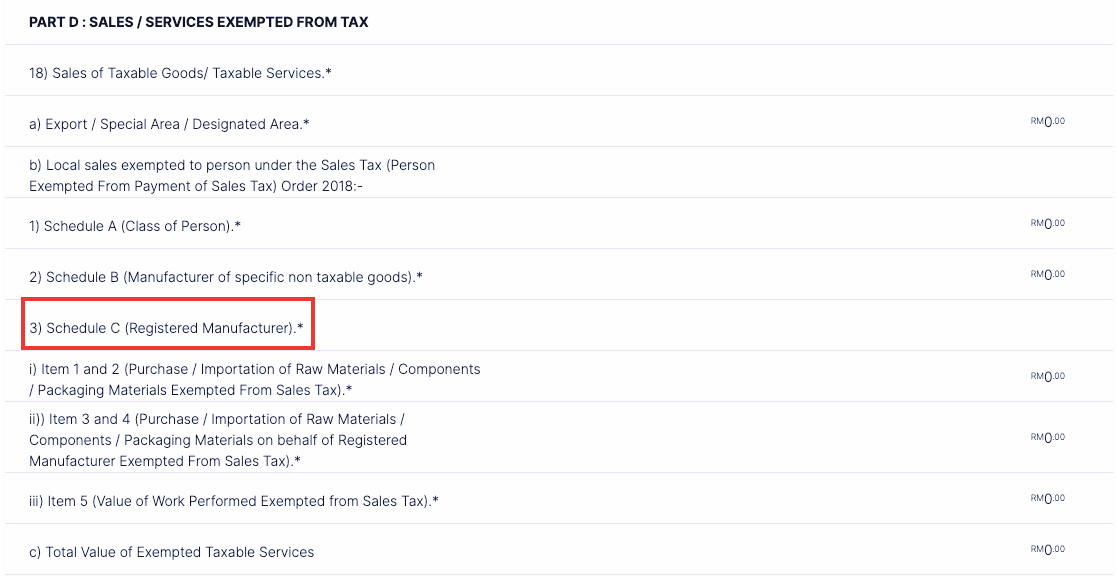

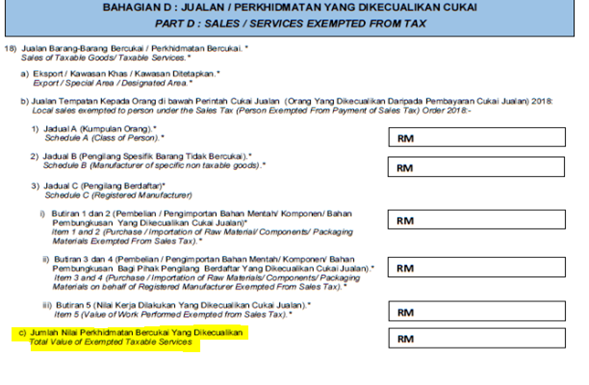

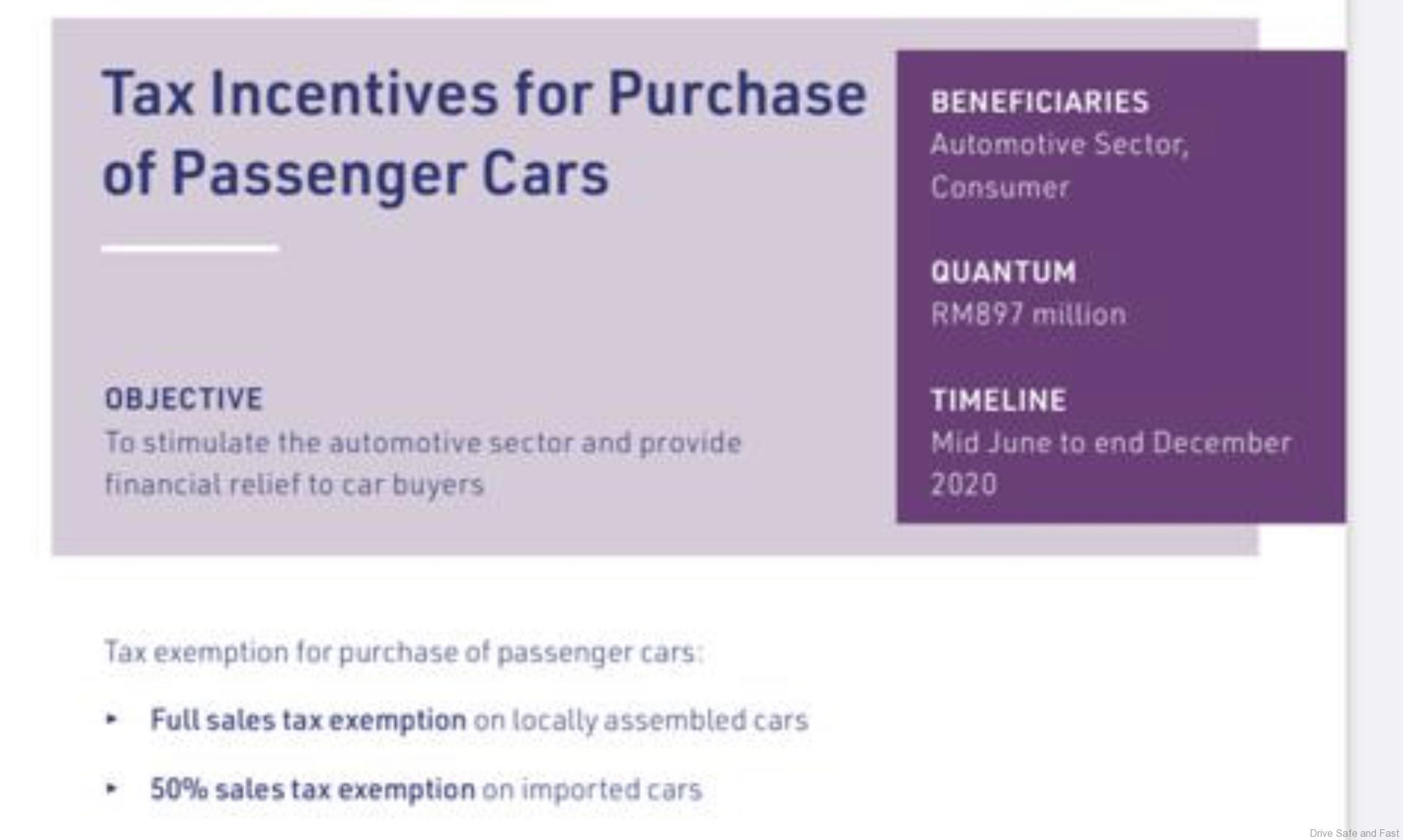

Sales tax exemption malaysia 2018. As you already know the government has announced that it will be waiving the 10 percent sales tax for locally assembled ckd cars while imported cbu cars will see their sales tax reduced by half to 5 percent. Goods are taxable unless they are specifically listed on the sales tax exemption list. Operation order 2018 v 3. The person solely carry on such manufacturing operations and does not carry on any other manufacturing activity.

Here are the details on how the sst works the registration process returns and payment of the sst and the transitional measures to take after the abolishment of the gst. What are the changes. The proposed sales tax will be 5 and 10 or a specific rate for petroleum. Guide on sales tax exemptions as at 28 august 2018 all rights reserved 2018 royal customs malaysia department.

The new sales tax will be levied on taxable goods that are imported into or manufactured in malaysia. Through proposed sales tax exemption order will be charged. Person exempted from sales tax order 2018 exemption from registration order 2018. Malaysia taxation and investment 2018 updated april 2018 3.

From 1 september 2018 the sales and services tax sst will replace the goods and services tax gst in malaysia. Alternatively the ita provides a 60 to 100 allowance on capital investments made up to 10 years. Sales tax exemption from registration order 2018 manufacturer whose operation as specified in schedule a of the order is exempted from registration irrespective of the total value of sales of taxable goods. The ita and ps incentives are mutually exclusive.