Socso Late Payment Penalty Malaysia

Perak extends late assessment payment penalty waiver arrear discounts till december says mb monday 19 oct 2020 05 13 pm myt perak mentri besar datuk seri ahmad faizal azumu said the offer which ended in august has been extended until december 31 under phase three of the state economic stimulus package aimed at easing the burden of the people and the business community during the covid 19.

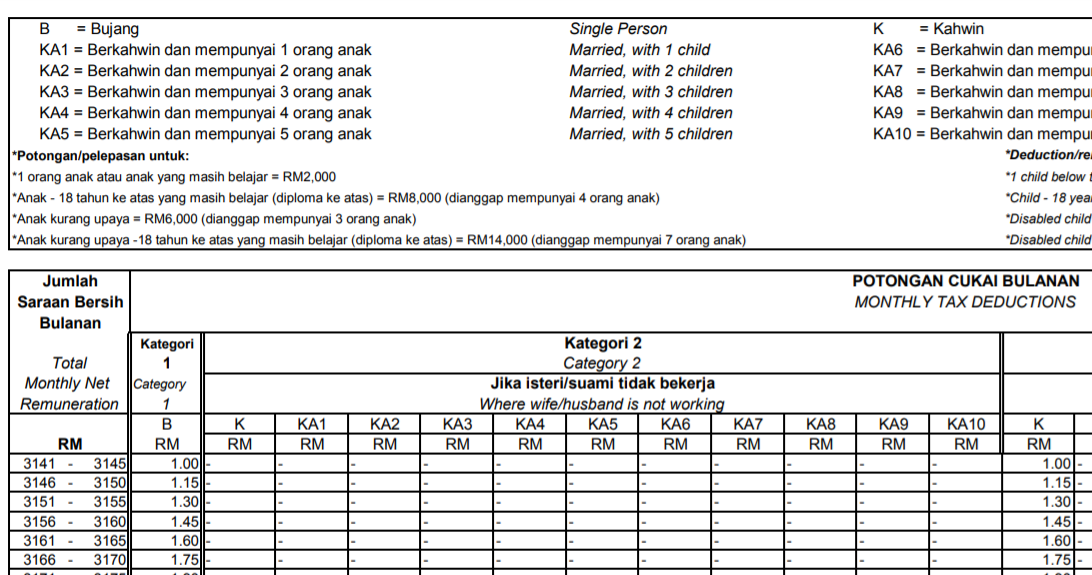

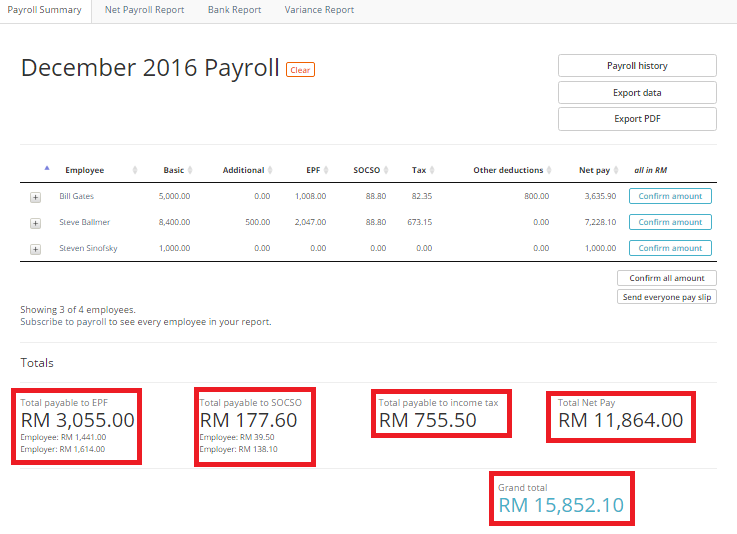

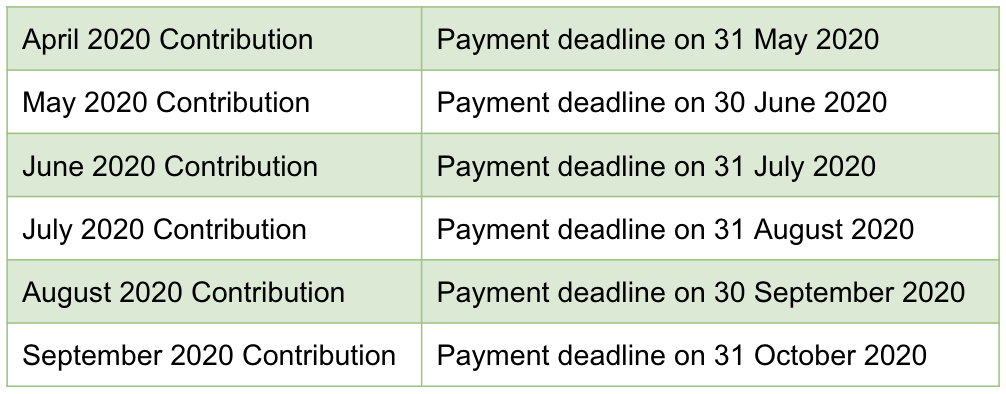

Socso late payment penalty malaysia. Ilpc is charged for late payment of contributions at the rate of 6 percent per annum for each day of late payment contributions. The monthly payment of socso contribution comprising of both employees and employer s share should be paid by the 15th of the month for the salary issued for the previous month. Upon late payment of epf challan two arrears ensue on the employer as follows. Furthermore a late payment penalty of 10 will be imposed on the balance of tax not paid after 30th april following the year of assessment.

If the tax and penalty imposed is not paid within 60 days from the date the penalty is imposed a further penalty of 5 will be imposed on the amount still owing. Perkeso socso perkesoofficial october 21 2020 selaras keputusan kerajaan berhubung status terkini pandemik covid 19 di negeri selangor wp kuala lumpur dan putrajaya perkeso telah memutuskan bahawa semua urusan temu duga yang dijadualkan mulai 14 oktober 2020 ditangguhkan kepada satu tarikh yang akan dimaklumkan kelak. A late payment interest rate of 6 per year will be charged for each day of contribution not paid. If the tax and penalty imposed is not paid within 60 days from the date the penalty is imposed a further penalty of 5 will be imposed on the amount still owing.

Nashnawi who was then 18 years old died in an accident while travelling from home to work in pasir gudang on feb 26 2010 but redzuan only submitted the accident report to socso on oct 4 last year. No payment required refer irbm faqs no 16 10 april 2020 for company entities that is sme paid up capital less than rm2 5m and revenue less than rm50m are allowable to defer the cp204 payment due on 15 04 2020 15 05 2020 and 15 06 2020 and for other company cp500 payment due on 31 03 2020 and 31 05 2020. Epf interest for late payment under section 7q. For example january contributions should be paid not later than february 15.

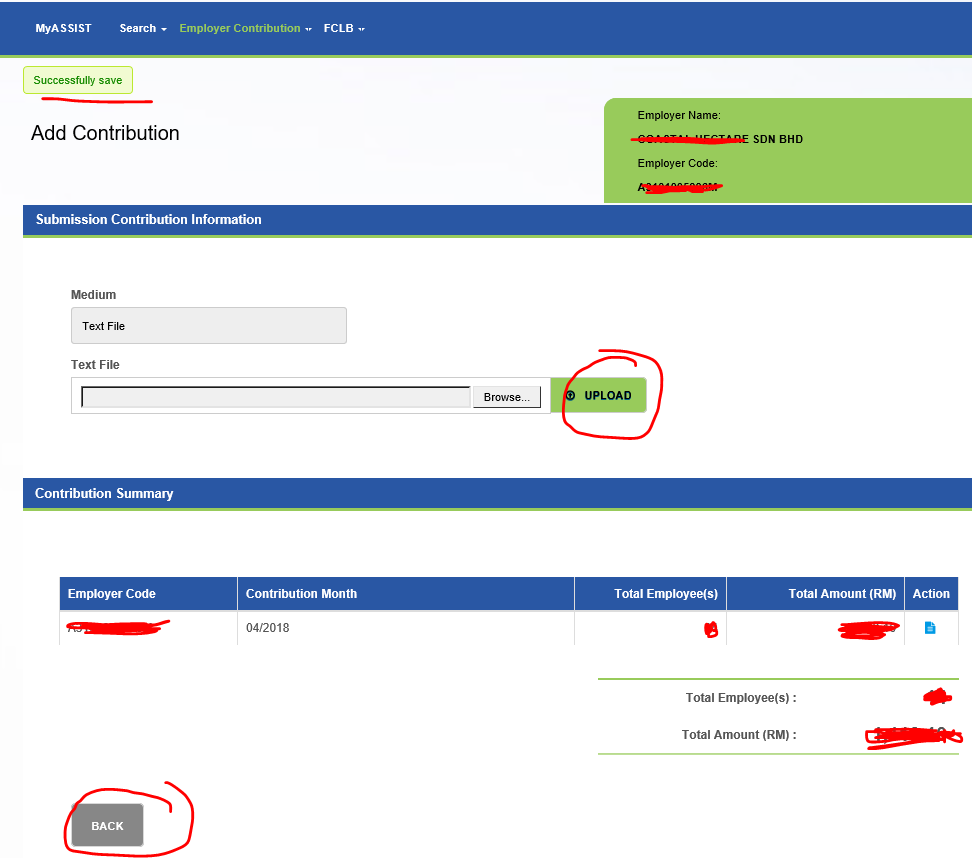

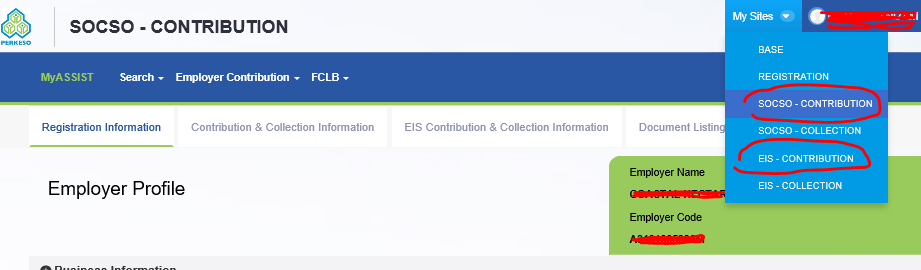

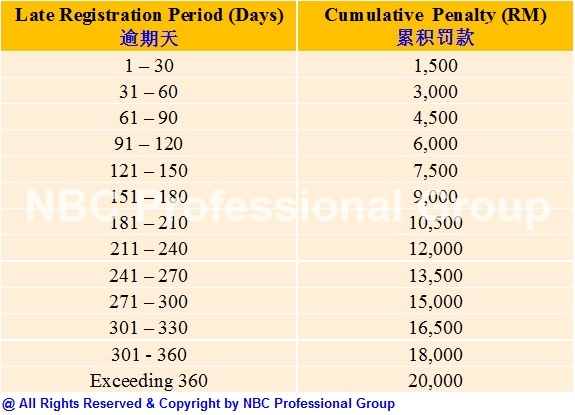

The district s social security organisation socso. Penalty for late payment a late payment penalty of 10 will be imposed on the balance of tax not paid after 30th april following the year of assessment. Ssm offers 90 discount on penalty compound valid until 30 4 2020. Failing to submit the forms remit the payment within the period will result in late interest penalty charged by perkeso.

The employer is liable to pay monthly contributions within 15 days of the following month.