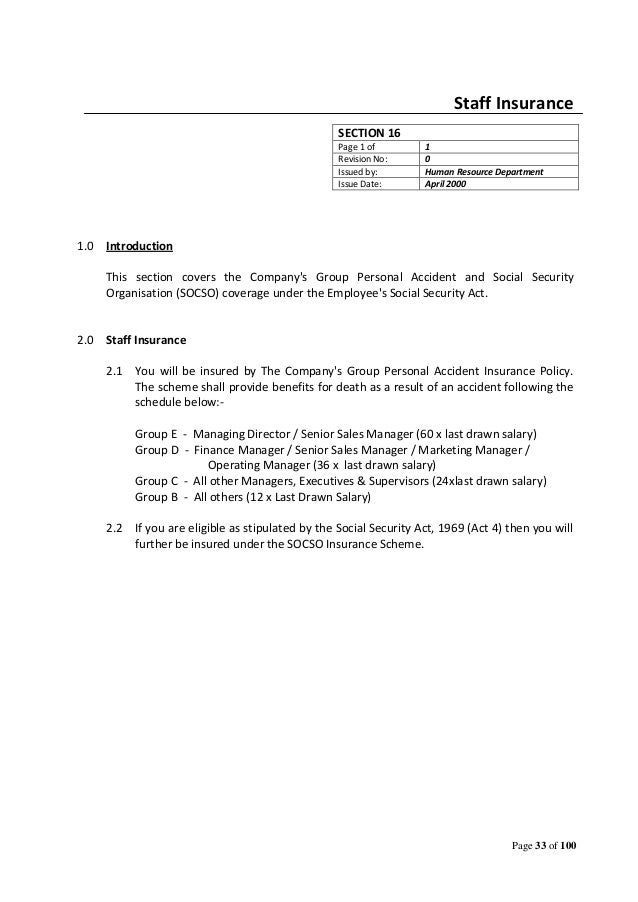

Socso Late Payment Penalty

Ilpc is charged for late payment of contributions at the rate of 6 percent per annum for each day of late payment contributions.

Socso late payment penalty. However failure to submit the forms and remit the payment within the period will result in late interest penalty charged by perkeso. Government servants foreign employers self employed persons sole proprietors partnership domestic servants or spouse are not eligible for socso protections. A late payment penalty notice was issued on 5 aug 2019 and business e eventually paid the gst and late penalties on 15 dec 2019. The total penalty imposed was 1 300 i e.

The district s social security organisation socso. Aug sep oct and nov 2019. Furthermore a late payment penalty of 10 will be imposed on the balance of tax not paid after 30th april following the year of assessment. The workshop was also ordered by magistrate afidah abdul rahman to pay late payment penalty of rm4 175 in six months.

Ssm offers 90 discount on penalty compound valid until 30 4 2020. The employer is liable to pay monthly contributions within 15 days of the following month. For example january contributions should be paid not later than february 15. Failing to submit the forms remit the payment within the period will result in late interest penalty charged by perkeso.

No of days delayed in making payment x 5 p a less than 2 months no of days delayed in making payment x 10 p a 2 months and above but less than 4 months no of days delayed in making payment x 15 p a 4 months and above but less than 6 months no of days delayed in making payment x 25 p a 6 months and above.