Sole Proprietorship In Malaysia Tax

As mentioned before the sole proprietorship is the most popular business structure in malaysia.

Sole proprietorship in malaysia tax. The statutory body who is in charged with the direct tax is the malaysia inland revenue board lhdn. A sole proprietorship must be registered with the companies commission malaysia the main institution where companies file for registration. This is because of the following laws set in place. Imoney has a useful guide about taxes made up of 11 short chapters.

A sole proprietorship is a business wholly owned by a single individual using personal name as. Tax submitted in 2017 is for 2016 income. A sole proprietorship in malaysia makes no difference between the natural person who owns it and the business sole proprietorships are pass through entities. The ssm of malaysia enforces the companies act 2016.

Depending on your nature of business you can register as sole proprietorship partnership limited liability partnership or company. All profits and losses go directly to the business owner. A sole trader is represented by the natural person who will carry business operations in his or her own name. In the case of sole proprietorship business chargeable income is his or her individual income.

Sole proprietorship registration is the most common and simplest legal business structure option in malaysia. The tax rate for sole proprietorship or partnership will follow the tax rate of an individual. As such sole proprietorships also fall under their jurisdiction. Sole proprietorship is governed by companies commission of malaysia suruhanjaya syarikat malaysia and registration of businesses act 1956.

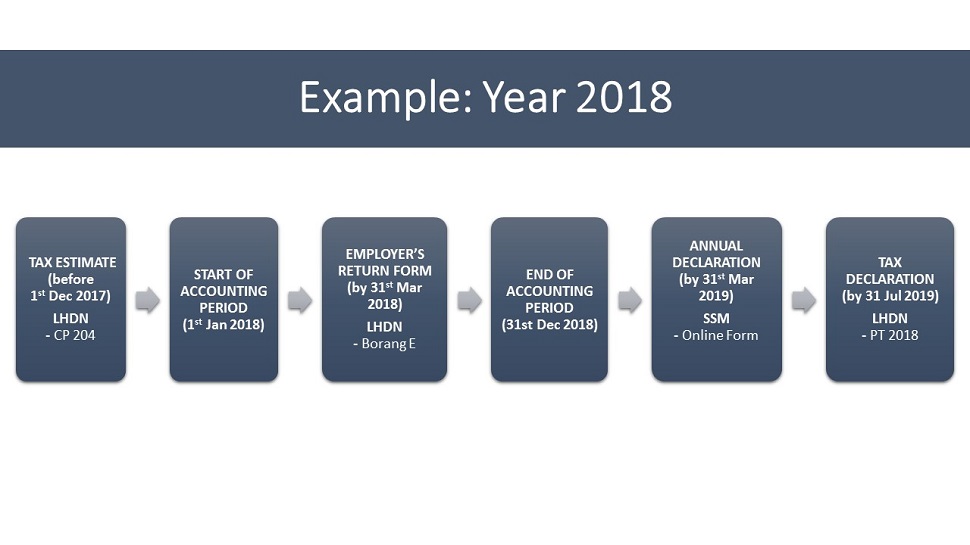

You make payment on income generated the previous year i e. Lembaga hasil dalam negeri lhdn inland revenue board irb who you pay your taxes to and where you register for tax filing. Suruhanjaya syarikat malaysia ssm companies commission of malaysia ccm where you register your llp get its birth certificate and do your annual declarations. An important aspect referring to the incorporation of a sole proprietorship here is that foreign persons are not allowed to incorporate this.

For many small scale online businesses in malaysia sole proprietorship single owner or partnership more than one owner is enough and the cheapest option. Sole proprietorship malaysia comes with enticing policies where the owner of the company doesn t need to corporate tax.