Stamp Duty For Tenancy Agreement Malaysia 2019

Rm500 billion in debt is the malaysian government bankrupt.

Stamp duty for tenancy agreement malaysia 2019. All instruments chargeable with duty and executed by any person in malaysia shall be brought to the collector who shall assess the duty chargeable. How do i calculate the stamp duty payable for the tenancy agreement. Legal fee for tenancy agreement period of above 3 years. Next rm 90000 rental 20 of the monthly rent.

As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement. Chat property malaysia author. Affixed stamp of digital franking are still in use for the stamping on documents. April 17 2019 at 4 01 pm reply.

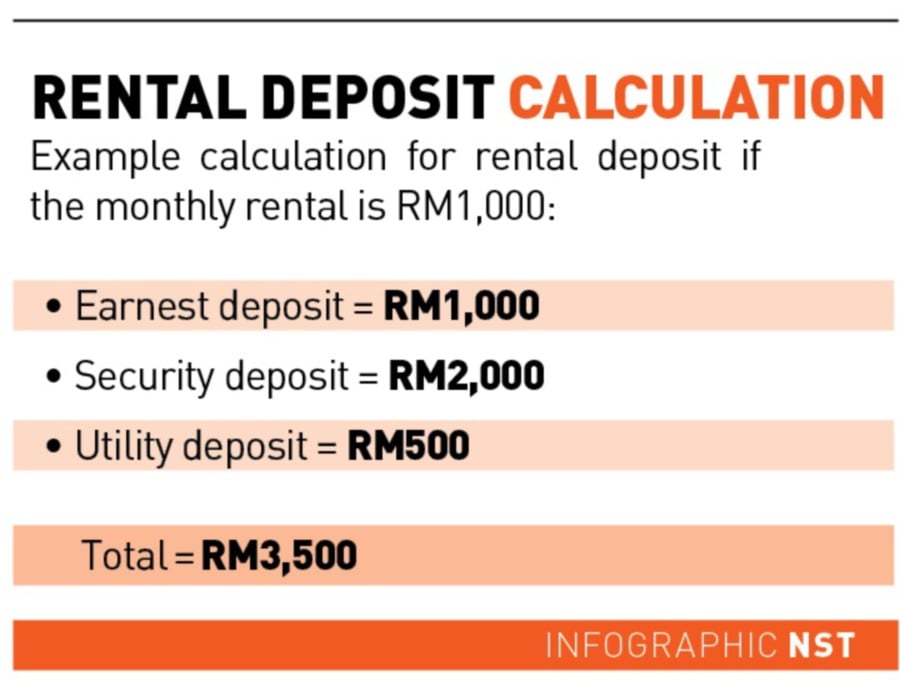

In summary the stamp duty is tabulated in the table below. Read answers from real estate professionals in malaysia to how much is the stamp duty for tenancy agreement. Tenant period is start from june 2019 till june 2020 may i write date of tenancy at 15th apr 2019 and go for stamping on apr 19. Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the.

Rental is rm800 month to comply with gdpr we will not store any personally identifiable information from you. While paying the stamp duty there are 2 application forms which you need to submit. Home calculators tenancy agreement stamp duty calculator. The tenancy agreement will only be binding after it has been stamped by the stamp office.

Stamp duty on any instruments of an asset lease agreement executed between a customer and a financier made under the syariah principles for rescheduling or restructuring any existing islamic financing facility is remitted to the extent of the duty that would be payable on the balance of the principal amount of the existing islamic financing facility provided instrument for existing islamic. Can i print the digitally signed tenancy agreement and use it for stamp duty at the tax office. If someone bought a property of rm1 5 million the buyer will need to pay 3 on the remaining amount after rm1 million but he or she will not need to pay any stamp duty tax for the loan agreement lim said during a press conference on hoc mapex 2019 today. However the stamping procedure remain unchanged in which duty payers are required to bring the original documents to be stamped at lhdnm stamp duty counter.

Tenancy agreement stamp duty calculator. The standard stamp duty chargeable for tenancy agreement are as follows. More than rm 100 000 negotiable q. To use this calculator.

Pds 1 and pds 49 a. How to open trading and cds account for trading in bursa malaysia. For example if someone bought a home priced at rm500 000 he or she will not need to pay spa and loan agreement stamp duty taxes at all. 2019 27 411 904.

An instrument is defined as any written document and in general stamp duty is levied on legal. About chat property malaysia. The amount paid would be calculated based on the annual rent.