Types Of Taxes In Malaysia

There are different types of tax in malaysia.

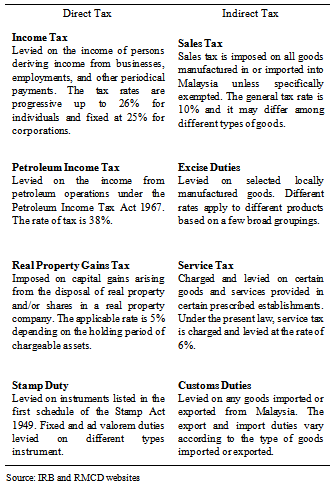

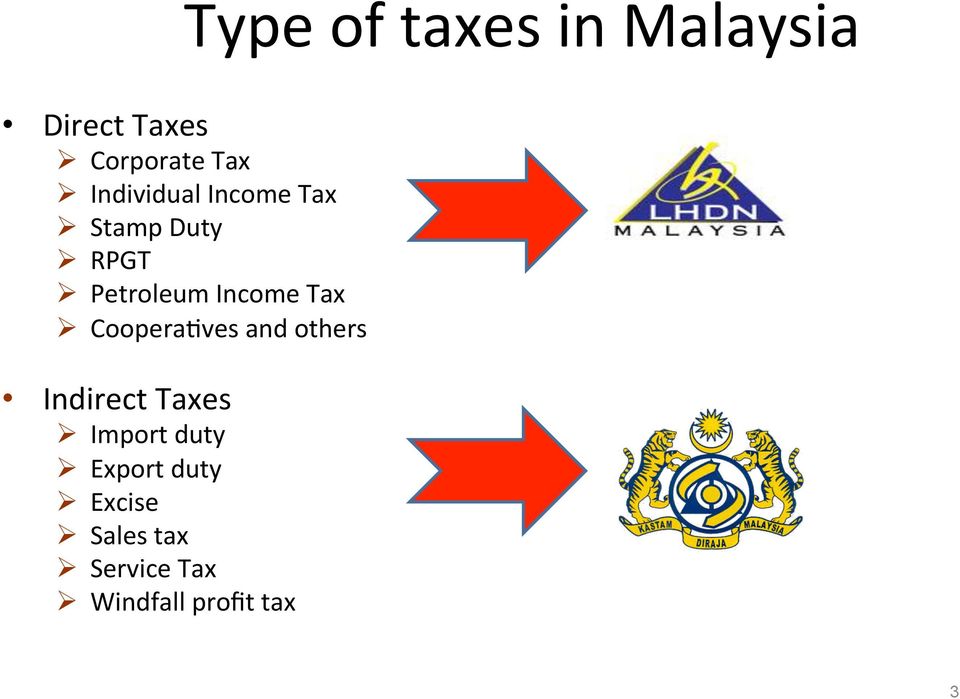

Types of taxes in malaysia. For other types of payments the withholding tax rate is 10 percent or 15 percent. The income is classified into 8 different tax groups ranging from 0 to 26. 10 for sales tax and 6 for service tax. Sales and service tax sst in malaysia malaysia has re introduce sst on 1 september 2018.

Type of indirect tax. What supplies are liable to the standard rate. The tax is paid directly to the government. Examples of direct tax are income tax and real property gains tax.

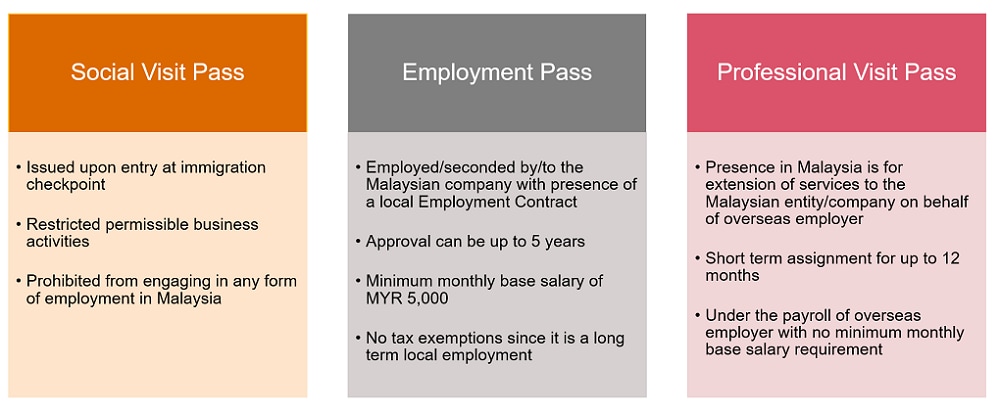

Tax deductions in malaysia are available in numerous cases including medical expenses purchase of books computers and sport equipment or education fees. These also apply to foreigners. Malaysia does not levy any tax on branch remittance. Road tax consumption tax property tax income tax etc.

There are two different kinds of taxes in malaysia which are a direct and indirect tax. The income tax rate for residents is calculated on the amount of income and is much more precise. Ms goh s main practice areas include all aspects of tax and revenue law such as income tax corporate tax real property gains tax customs duties sales tax service tax double taxation treaties labuan business activity tax labuan entities labuan trusts and foundations stamp duty tax incentives for investments personal trusts charitable trusts and tax litigation.