How To Remove Employee From Epf Contribution

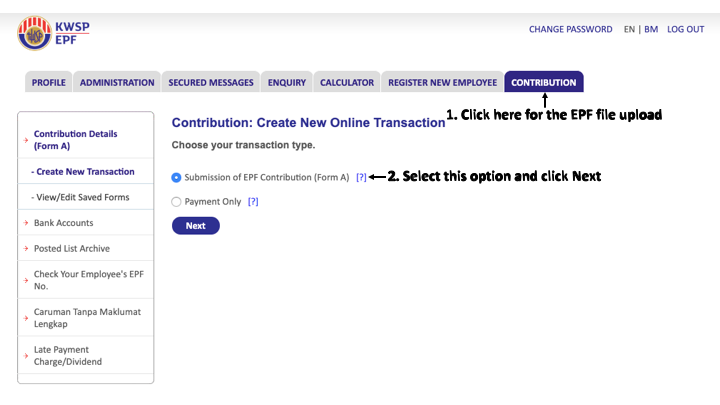

The employees provident fund epf or commonly known as kumpulan wang simpanan pekerja kwsp is a social security institution formed according to the laws of malaysia employees provident fund act 1991 act 452 which manages the compulsory savings plan and retirement planning for private sector workers in malaysia.

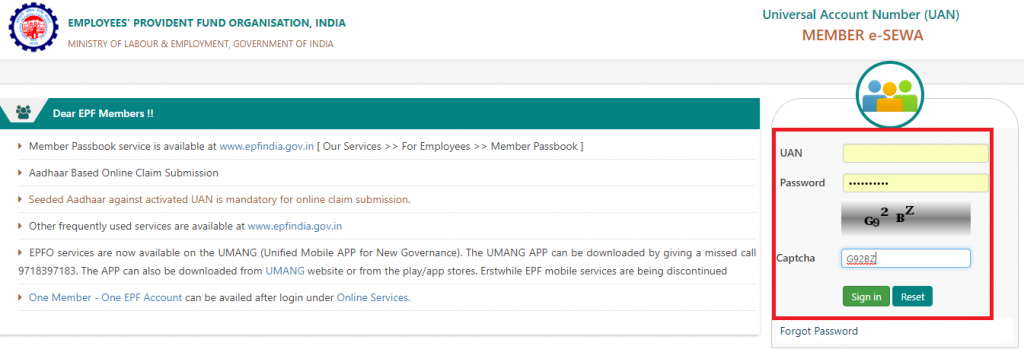

How to remove employee from epf contribution. The employer must pay their employee s contributions on or before the 15th of the following wage month. Cpf contribution for employees. Membership of the epf is mandatory for malaysian citizens employed in the. The employee s contribution is fixed.

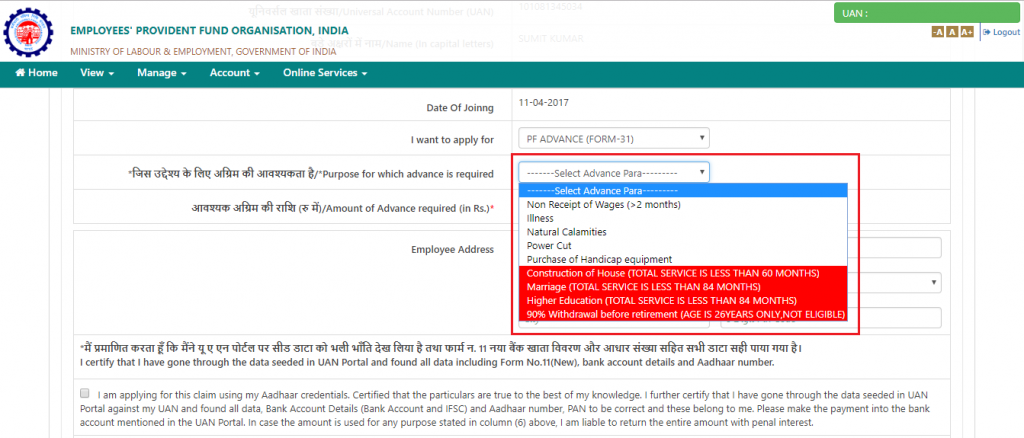

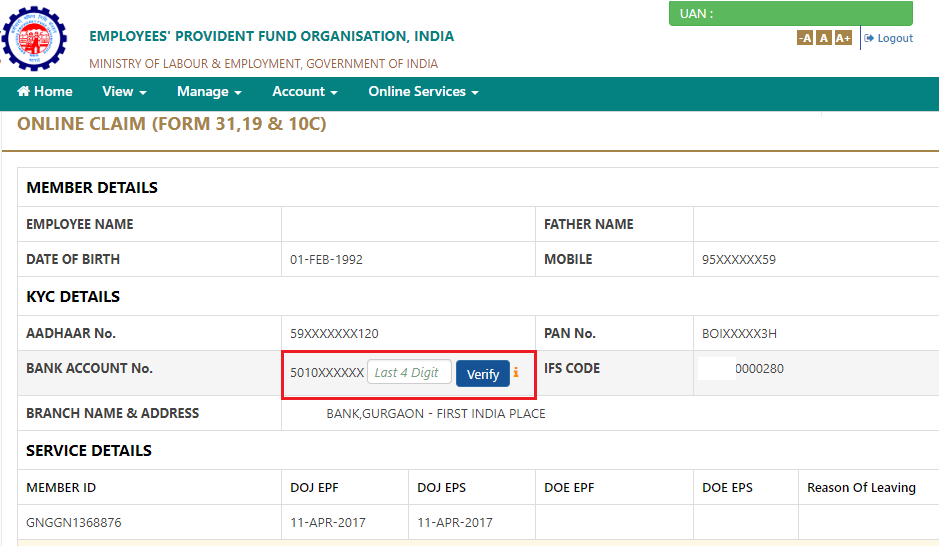

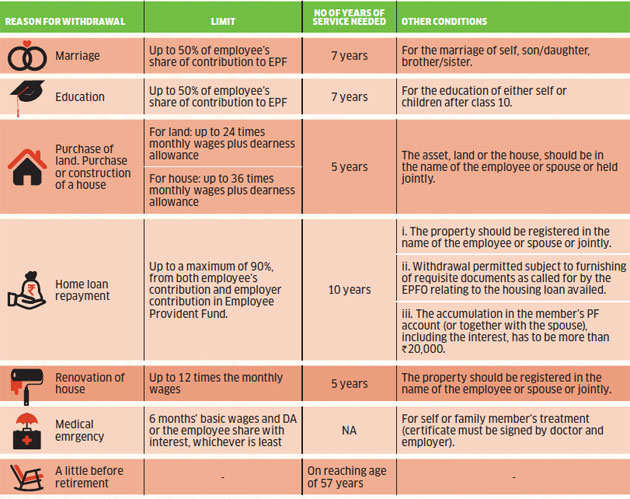

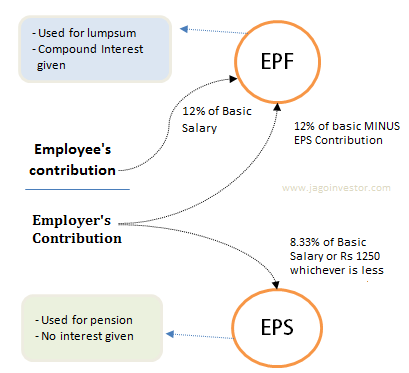

Hi there i am entering the employee details and want to remove the employee epf contributions seems like there is no option for no contribution it show the 4 is the lowest rate. These contributions are done monthly and the interest rate fixed depends on the employee s basic salary along with other dearness allowance. The employer must initially pay to the epf both his and the employee s shares. The contribution amount of employer and employee shares shall be based on the contribution rate third schedule of the epf act 1991.

Cpf contribution for employees p your employer is required to pay your cpf contributions every month if you earn more than 50 per month. It is 12 of the basic pay. However the employer may recover the employee s share of the contribution by deducting it from the employee s wage when the wage is paid to the employee.