Income Tax Return Formula Philippines

When to file income tax return.

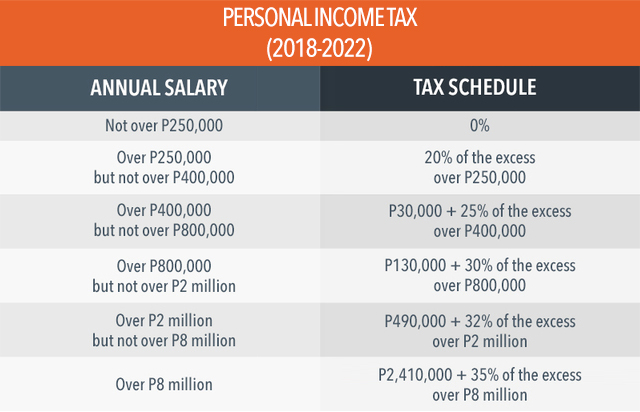

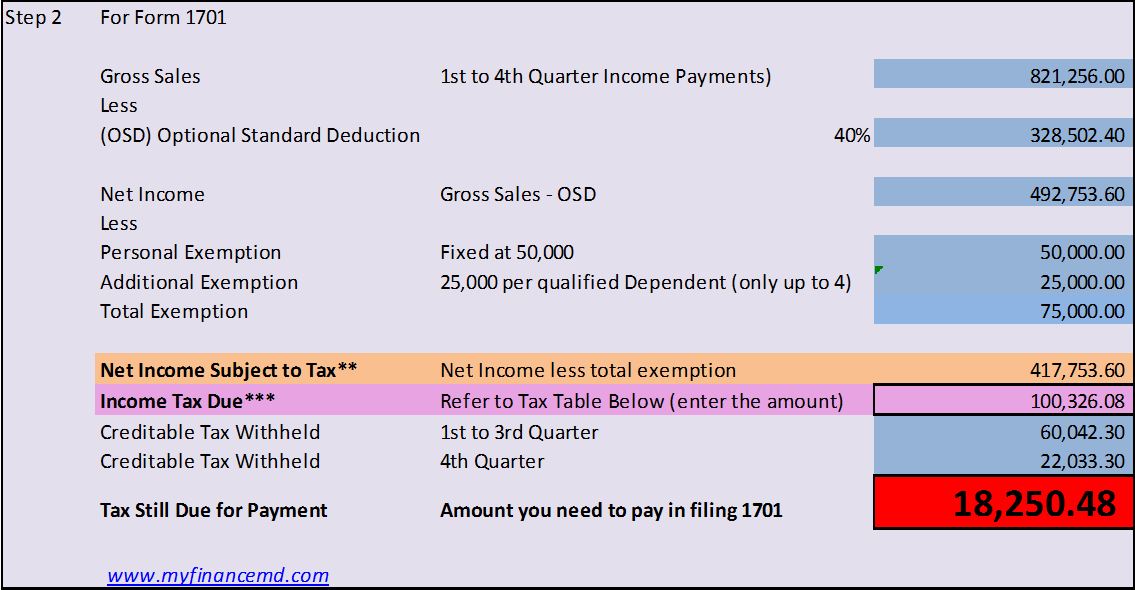

Income tax return formula philippines. Paying p190 000 income tax on taxable income of p1 million the taxpayer is charged an effective income tax rate of 19. How to compute tax refund in the philippines. 1701q in triplicate copies compensation income need not be reported in the quarterly income tax return and is to be declared only on the annual income tax return. With the new tax reform middle and low income earners will be exempted from income tax.

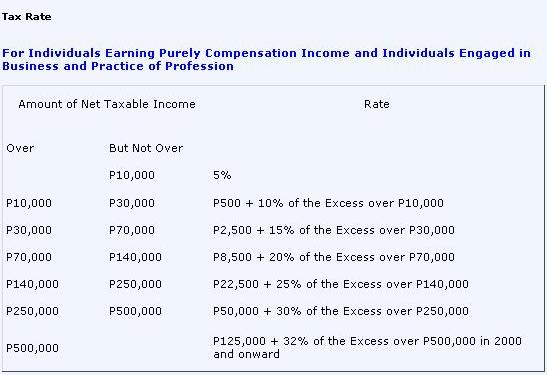

The deadline for filing income tax returns in the philippines for freelancers and self employed individuals is april 15 every year. The employee has a basic salary of php 30 000 monthly or php 360 000 annually. For non resident aliens not engaged in trade or business in the philippines the rate is a flat 25. The annual income tax return summarizes all the transactions covering the calendar year of the taxpayer.

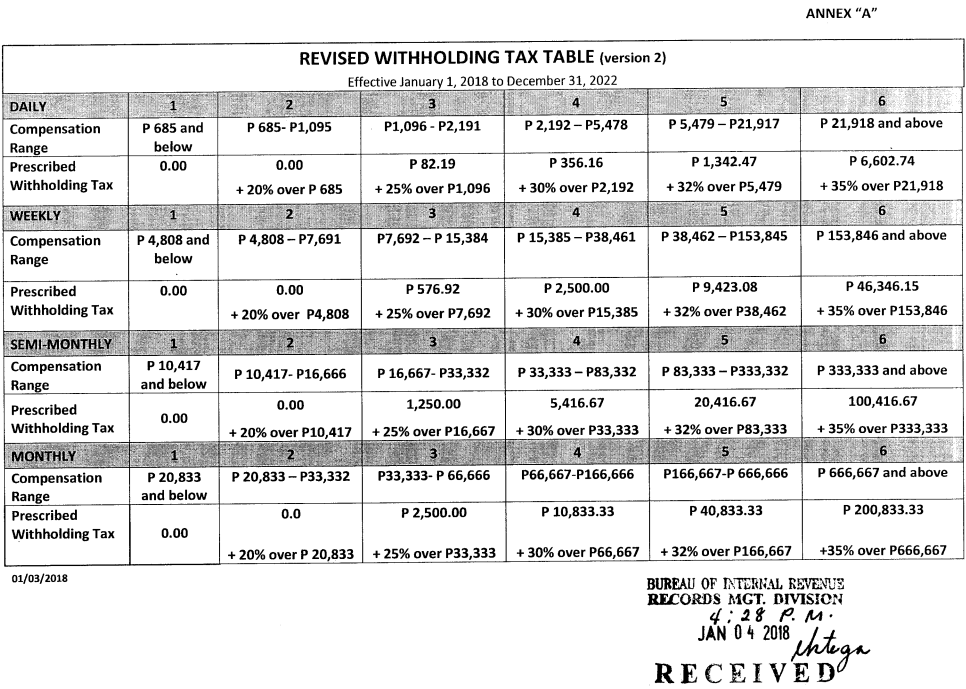

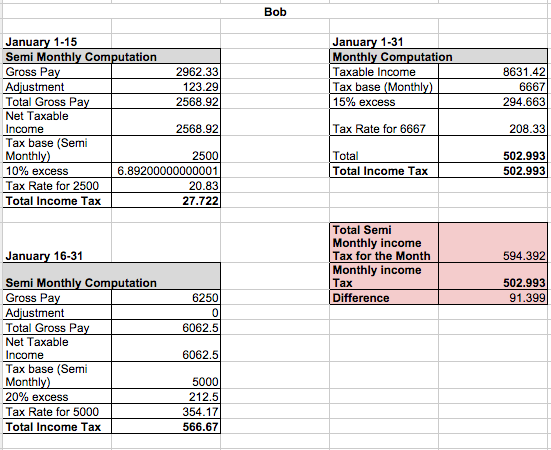

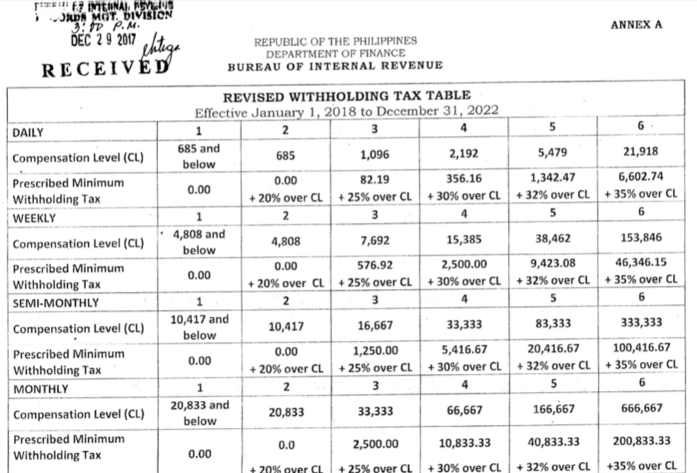

The above individual tax calculation also applies to non resident aliens engaged in trade or business in the philippines for their philippine source income. General formula for computing annual income tax refunds. Get the annual gross income. The tax caculator philipines 2020 is using the lastest bir income tax table as well as sss philhealth and pag ibig monthy contribution tables for the computation.

For resident and non resident aliens engaged in trade or business in the philippines the maximum rate on income subject to final tax usually passive investment income is 20. Tax due prepaid tax payments tax payable or refund. The formula to follow though is still the same. Tax rates for income subject to final tax.

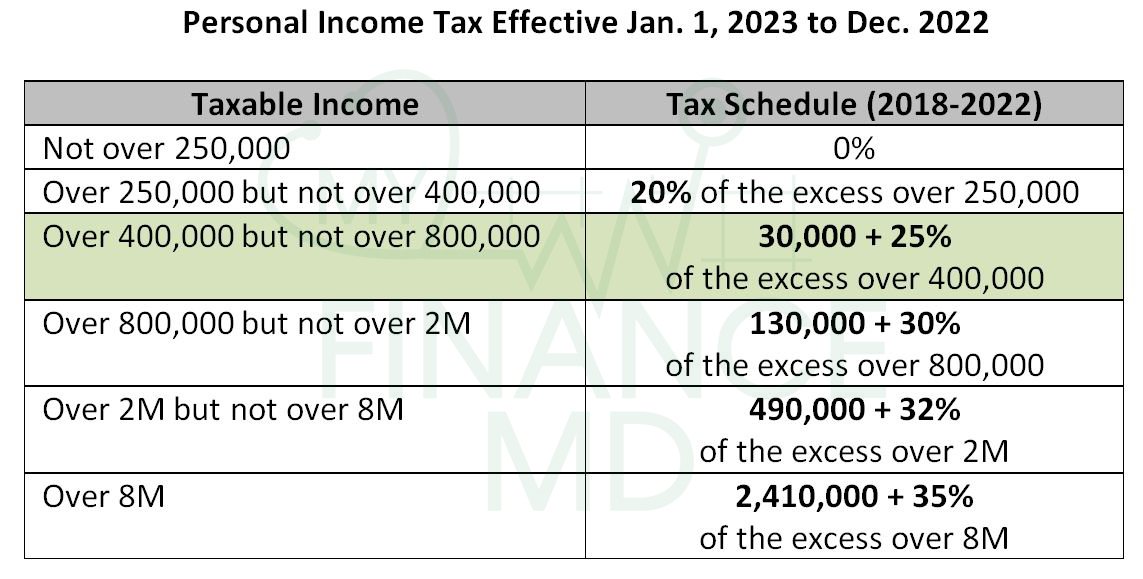

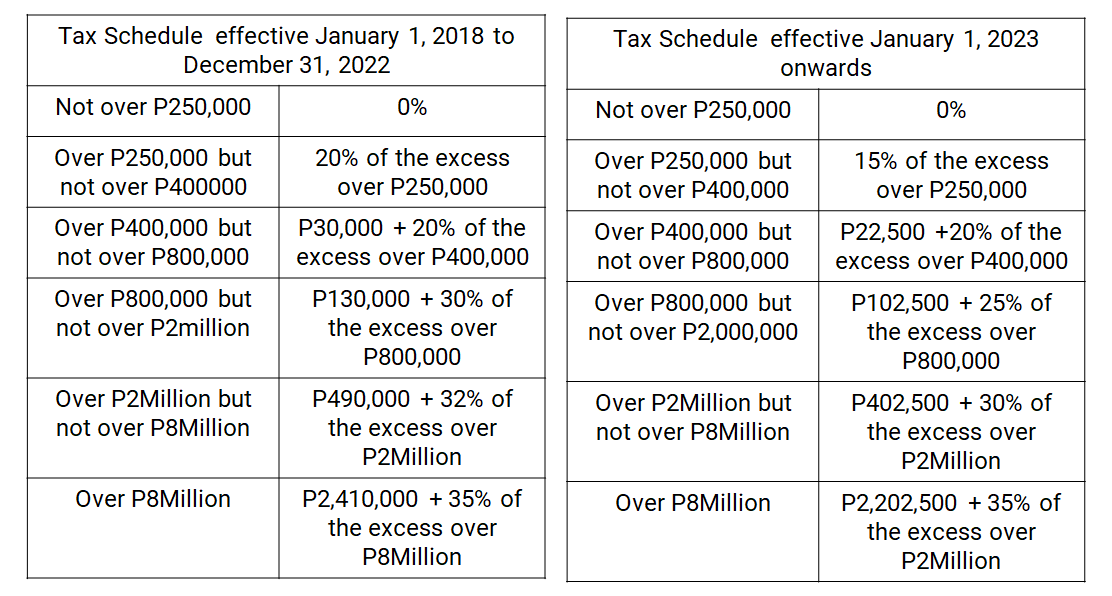

A resident citizen engaged in trade business or practice of profession within and without the philippines. Compensation income for employees. As a managerial employee the housing benefit provided to the husband shall be subject to fbt rather than income tax. Income tax computations under train from year 2023 onwards now from the year 2023 onwards a new graduated income tax tables will be in use.

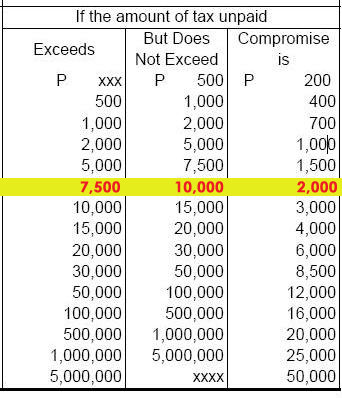

Proceed to the revenue district office where you are registered or to any tax filing center established by the bir and present the duly accomplished bir form 1701q together with the required attachments. Workers earning less than 21 000 a month will be exempted because their salary is less than the lowest tax brackets implemented in the new tax reform. Failure to meet the deadline will result in penalties such as a 25 surcharge of the tax due and a 12 interest per year from the deadline of payment until full payment of the amount. This bir tax calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income.

Fill up the bir form no. This return shall be filed by the following individuals regardless of amount of gross income. This is done by raising the minimum taxable income.

:max_bytes(150000):strip_icc()/Netoftax-taxrates-464cac356d8c468c97eb98a8e92f4052.jpg)