Malaysia Income Tax 2016

However there are some exceptions to the matter.

Malaysia income tax 2016. Amendment at income tax deduction from remuneration determination of amount of monthly tax deduction for additional remuneration of previous years. Malaysia has a progressive income tax system which means the more you earn the more you will need to pay. Kuala lumpur 30 march 2016 preparing and filing your income tax in malaysia can be a challenging and anxiety inducing experience every year for most people. Home income tax rates.

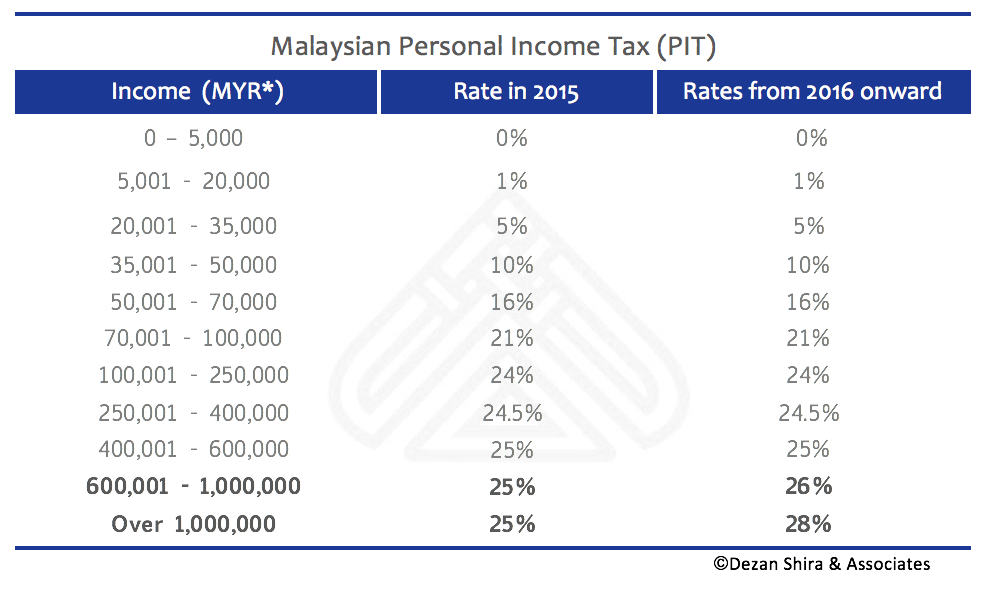

The amount of monthly tax deduction of additional remuneration before the year 2016 which is received in the current year shall be calculated in accordance with the method and table of monthly tax deduction applicable for the year it is. W e f ya 2016 tax rates for resident individuals whose chargeable income from rm600 001 to rm1 000 000 be increased by 1 and chargeable income exceeding rm1 000 000 increased by 3. Following the tabling of budget 2016 it was announced that high income earners who are earning more than rm1 million per annum will be charged 28 income tax which is an increase of 3 from the previous year. Calculations rm rate tax rm 0 5 000.

Assessment year 2016 2017. 1 for non residents of malaysia people who have been living in the country for less than 182 days per year the tax rate has been set at 25 on all the income that has been earned in malaysia regardless of your citizenship or nationality. Calculations rm rate tax rm 0 5 000. 20 percent on the first myr 500 000 19 percent from ya 2016 25 percent on every ringgit exceeding myr 500 000 24 percent from ya 2016.

Income tax rates for resident individuals whose chargeable income from rm600 001 to rm1 000 000 be increased by 1 from 25 to 26 and chargeable income exceeding rm1 000 000 be increased by 3 from 25 to 28 from year of assessment ya 2016 as follows.