Malaysian Labour Law Overtime Calculation

Calculate overtime pay for a monthly rated employee if you are a monthly rated employee covered under part iv of the employment act use this calculator to find out your pay for working overtime.

Malaysian labour law overtime calculation. What are the overtime rates according to the employment act. You can claim overtime if you are. The limit to overtime work is covered in the employment regulations 1980 stating that overtime work shall be a total of 104 hours in any 1 month. A non workman earning up to 2 600.

Top 10 legal mistakes made by employers 5 employment law tips for startups. Malaysia day overtime rate according to malaysian employment act 1955. If the employee s salary does not exceed rm2 000 a month or falls within the first schedule of employment act. Employee retrenched by company.

Average true days wages 1450 x. In this article we will study the laws governing the hours of work and overtime work for employees under malaysia s labour laws. Rules explained in this article apply to employees covered under the employment act e g. 2 any employer who fails to pay to any of his employees any overtime wages as provided under this act or any subsidiary legislation made thereunder commits an offence and shall also on conviction be ordered by the court before which he is convicted to pay to the employee concerned the overtime wages due and the amount of overtime wages so ordered by the court to be paid shall be.

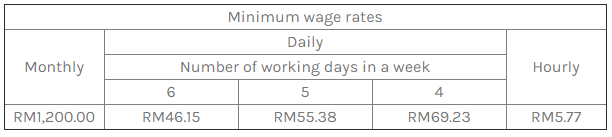

The overtime calculator rate payable for non workmen is capped at the salary level of myr1250 00 and have work of 44 hours a week for overtime calculator for payroll software malaysia work your employer must pay you at least 1 5 times the hourly basic rate of pay. Entitlement as per reg 6 of the employment termination lay off benefits regulation 1980 20 days for every month of service. Worked there for 8 years and 5 months and is earning rm1450 a month. Overtime work is all work in excess of the normal hours of work excluding breaks.

Wages not exceeding rm2 000 manual labourers but can also be used as guidelines for other staff. A non workman earning up to 2 600. Myths about malaysian employment law. Payment must be made within 14 days after the last day of the salary period.

You can claim overtime if you are. How much should his benefits be. Yet it can be done if there is an agreement between employer and employees in a contractual entitlement. The overtime rate payable for non workmen is capped at the salary level of 2 600 or an hourly rate of 13 60.

A workman earning up to 4 500. For staff members whose monthly salary is or to rm2 000 and any increase of salary where the ot is capped at rm 2 000 00 the company pays the following overtime rate which is in accordance to the rate provided by the malaysian employment act 1955 as follows. Malaysian employment law can look confusing complicated and even tricky at first glance. But overtime can be a very confusing matter.

However having the right source of information will make navigating malaysian employment law much simpler.